When doing business, it’s important to practice clear and formal communication with your clients. One way you can do this is to send comprehensive and professional invoices. But is it mandatory to send an invoice for every transaction?

What is an invoice?

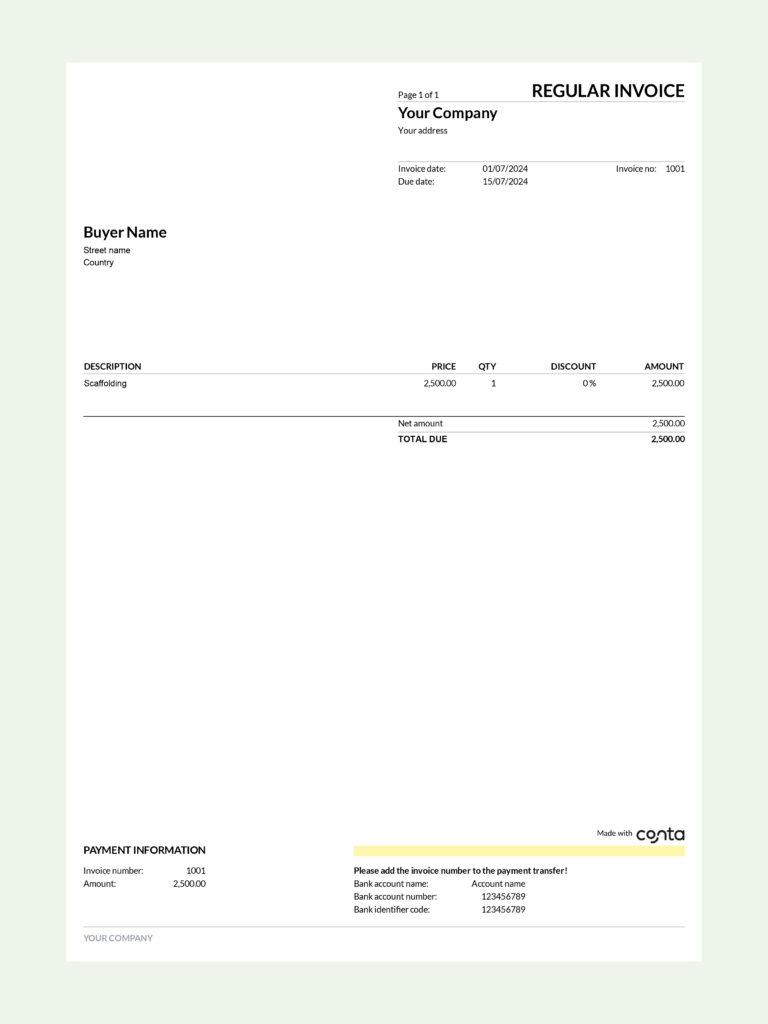

An invoice is a detailed document that a seller issues to a buyer, outlining which goods or services were provided and the amount owed. It serves multiple purposes in a business transaction, acting as both a request for payment and a record of the sale.

It also helps you manage your finances and ensure that your business keeps accurate records for tax purposes.

This is what an invoice could look like:

With the free invoicing software from Conta, you can create, send and manage invoices—for free! Conta is trusted by more than 200 000 businesses.

Send invoices for freeSee also: 5 invoicing tips for beginners

Do I have to make an invoice?

The rules vary from country to country, but generally you’ll need to create invoices either manually, by using an invoice template or by using invoice software, to ensure you have the correct documentation.

While you might not always need to issue invoices for B2C transactions, it’s usually a good idea for you as a business owner to provide clients with a professional and valid invoice in order to get paid.

See also: How to send an invoice

The benefits of invoicing

Clear and professional invoices helps your business communicate better, keep accurate records, ensure timely payments, and manage finances more effectively. Here are some key benefits of sending an invoice:

Clear communication

Sending an invoice ensures that both the buyer and the seller have a clear understanding of the goods or services provided, as well as the total amount due and payment terms. This reduces the risk of misunderstandings and disputed invoices.

Read also: Be the first to get paid

Formal records

An invoice serves as a formal record of the transaction. It documents the details of the exchange, including what was sold, at what price, and any applicable taxes. This formal record is invaluable for both parties, especially if any issues arise later.

Timely payments

Invoices help you get paid in a timely manner. By clearly outlining the payment terms and due dates, it helps ensure that payments are made promptly. This in turn improves cash flow and financial stability for your business.

Accounting and tax reporting

Invoices are crucial for accurate accounting and tax reporting. They provide a clear paper trail of all transactions, making it easier to track sales, manage expenses, and prepare for audits. Proper invoicing helps your business meet tax obligations and avoid penalties.

Send invoices for free

Running a business can be hard. That’s why we’ve made our invoicing software free of charge. It’s simple and intuitive, and you can make an invoice in just a few minutes.