Not sure how to make an invoice? We’ve created a sample invoice for self-employed—and with this free invoice tool, you can make your own invoice in minutes.

Have you just completed your first job as self-employed, and now the client is asking you to send an invoice? Then you’re probably wondering how to make an invoice, and what the invoice should include.

Here’s a free sample invoice for self-employed to get you started! Read on for step-by-step instructions.👇

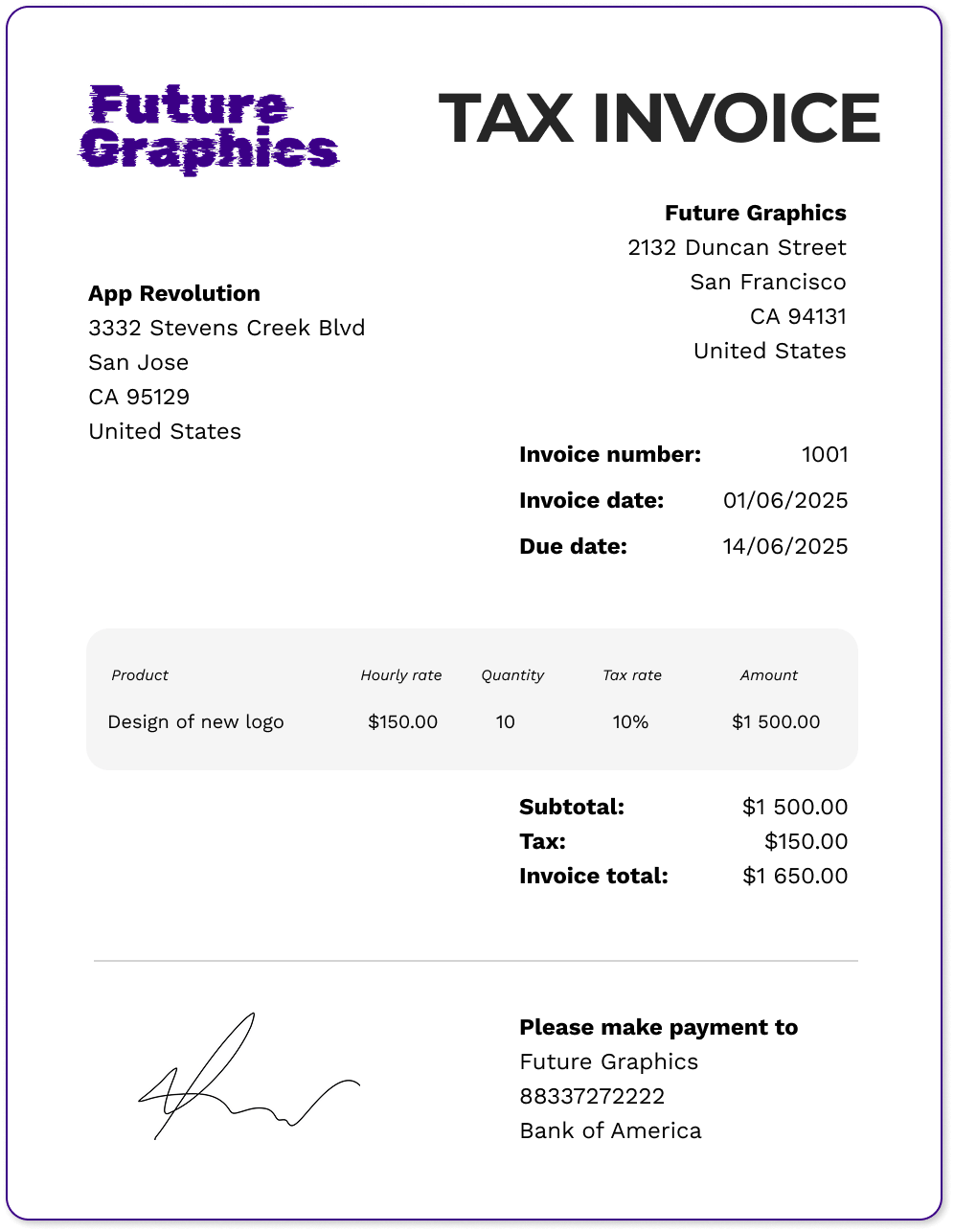

1. Start with the basics

Add your information, such as your name, brand name, address and contact information at the top of the invoice so that the buyer knows who it’s from.

You should also clearly mark it as an invoice, or a tax invoice, if you’ve included sales tax.

Then add the buyer’s name, business name and address so it’s clear who the invoice is for.

An invoice is an important sales document that shows that goods or services were sold, so it’s important for both you and the buyer that you’re correctly identified on the invoice.

2. What’s invoice number and invoice date?

These might seem confusing, but they’re actually quite simple: Each invoice you make has to have a unique invoice number. This helps you and the buyer refer back to them, but it’s also important for accounting and auditing purposes.

It should be possible for a third-party to review all your invoices.

The invoice date is the date the invoice was issued. The invoice date helps you work out the due date.

3. Products and prices

You need to clearly state what was sold, in the example above a graphic designer has charged an hourly rate for designing a logo. In addition to a description of what was sold, you also have to add the unit price or hourly rate, the tax rate for each product and service, and the amount.

Below the products, you should list the subtotal without tax, the amount of tax, and the total invoice amount that the client has to pay.

4. Due date and payment terms

Speaking of payment, it’s important to add the date payment is due. There are many different payment terms to choose from, for example 14 days or 30 days after the invoice was issued. Read more about payment terms.

Payment terms also include how you want the buyer to pay you, for example via bank account transfer or through a payment gateway such as PayPal or Stripe. Make sure to put enough information on the invoice for the buyer to pay you.

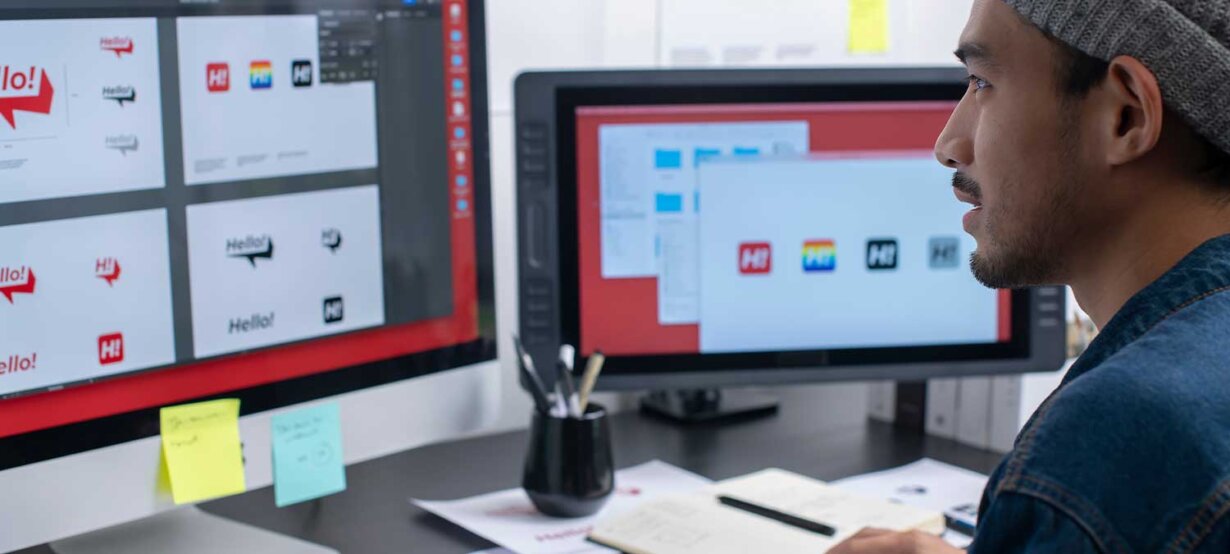

5. Don’t forget about branding

You should customize the invoice to your brand: The easiest way to do that is by adding your logo. You can also upload a signature. In some cases, it’s required to verify the invoice, but you can also add it for a more professional aesthetic.

It’s also a good idea to thank the client for their business. In fact, research shows that including the words ‘thank you’ and ‘please’ are more than 40 percent likely to get paid within 7 days.

Ready to make your first invoice?

If you use free invoicing software, you’ll be guided through the steps, and you can make an invoice in 2 minutes.