An invoice is not just a request for payment; it’s the lifeblood of your business and an essential tool for managing cash flow. When you sell goods or services, creating an invoice is the next step to getting paid. This is what you need to know for understanding invoices.

In this guide, we’ll help you in understanding invoices.

What exactly is an invoice? Picture it as a detailed note to clients that breaks down the products or services you’ve provided and asks for payment in return. This note is much like a financial handshake – it’s both a record of an agreement between you and your customer and a professional courtesy, encouraging prompt payment.

See also: The ultimate guide to liquidity and cash flow

Understanding invoices

There are certain things that should be included on invoices:

1. Business details

Clearly state the word ‘Invoice’ and include your business name, address, contact details, and the organization number, if you have one.

2. Client details

Just like you’ve identified yourself, you have to provide the client’s name and address so it’s clear who the invoice is for. You’re required to identify the seller and buyer, and it’s also a sign of professionalism to format the invoice correctly.

3. Invoice details

Every invoice should have a unique number – this is crucial for bookkeeping and auditing purposes. Additionally, you have to include the invoice date: the date the invoice was issued.

4. List of products or services

Include a detailed description of what you’re charging for – whether it’s products or services, list them out along with the quantities and unit prices.

5. Tax, if applicable

If you’re issuing a tax invoice, you have to specify the tax rate, the tax amount and the total, including tax.

6. Payment terms

When is the payment due? How should the client pay you? Provide clear payment terms so that it’s easy for them to pay you.

See also: What are payment terms?

Why professional invoices matter

Professional invoices showcase your brand’s integrity and professionalism. A carefully-designed invoice made with the free invoicing software from Conta does not just ensure that you can get paid, it reinforces trust and solidifies your business reputation.

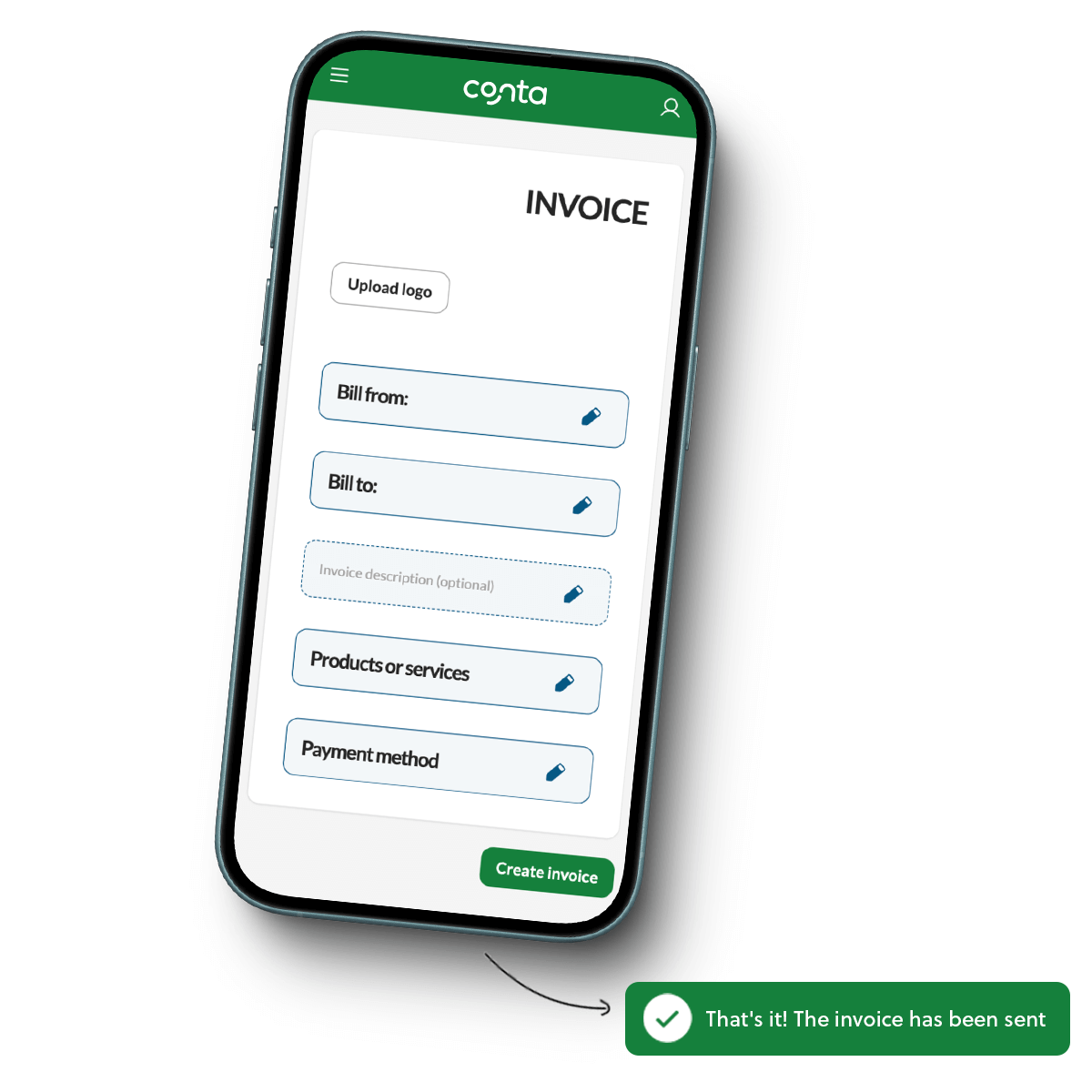

In the digital realm, paper is passé, and digital invoicing is king. Conta is at the forefront, delivering state-of-the-art invoicing software tailored for modern businesses. You can simplify your invoicing, increase efficiency, reduce the margin for error, and importantly, speed up client payments. Conta provides a secure, easy-to-use, and fully trackable invoicing solution, ensuring your business not only keeps up with the digital age, but stands out.

The best part is that it’s completely free.

Easier invoicing with free invoicing software from Conta

The [homelink_text=”free invoicing software”] from Conta has no subscription fees, no usage caps—just unlimited invoicing at your fingertips.

You can use Conta on your phone, laptop or tablet. There’s no need for cumbersome downloads or installations—access Conta directly through your browser or through the app, and enjoy:

A user-friendly interface

Conta’s platform is designed for simplicity, making it easy to create and send invoices.

Real-time management

From sending invoices to recording payments, everything is updated on the spot, making you more efficient.With our platform, you’re equipped to encourage prompt payments effortlessly, fortifying your business’s financial health with every transaction. These are the benefits of using Conta:

Zero cost, zero compromise

Enjoy the all the features of Conta without spending a dime. Your earnings increase; your costs do not.

Unlimited potential

Send unlimited invoices, add up to 5 clients, add up to 5 products and services—all within a user-friendly system.

Real-time tracking

Monitor each invoice with our comprehensive dashboard, which gives you a clear overview of your business’s finances.

Send invoices for freeMobile invoicing with Conta: Download the app and get started now

We know you sometimes need to do work on the go. That’s why we’ve developed a free mobile app perfect for small businesses and entrepreneurs constantly on the move. Picture the freedom of creating, sending, and tracking your invoices from any place, at any time. Download now and get started:

The pros of using the Conta phone app

It lets you:

– Stay flexible: Run your business from the palm of your hand. Whether you’re out meeting clients or balancing work and life, your invoices are right there.

– Respond instantly: Operate in real-time by sending out invoices the moment a job is done. Don’t wait to get back to the office—capitalize on the immediacy mobile invoicing offers.

– Keep track: Stay updated on overdue invoices. With Conta, you can easily see which invoices you need to follow up on.

Check this before sending an invoice

Before sending an invoice, take a moment to check the details. These straightforward will save you time and uphold your reputation:

1. Double-check the basics

Confirm that the client’s name, address, and contact information is correct. A small typo can result in payment delays.

2. Verify the numbers

Check the quantities, prices, and total amounts. Make sure the math adds up and that you’ve listed all the goods or services provided.

3. Review the tax details

Ensure that the tax is calculated correctly. Conta’s automatically calculates tax when you select a tax rate, which reduces the risk of errors.

4. Confirm the payment terms

Cross-check the payment terms and the due date. Laying out the terms helps avoid disputes and encourages timely payments.

5. Check the invoice number

Check that the invoice number is correct and follows your usual numbering system. This will help keep your records more organized and also avoid issues in case of audits.

Remember, with Conta’s user-friendly interface and smart features, you can create professional invoices that reflect the professionalism of your business.

Conclusion: How to get good at invoicing

Whether you’re running a fledgling business or an established enterprise, mastering invoicing will streamline your operations and ensure a steady cash flow. Understanding invoices is the best first step.

Invoicing is about more than sending a bill: It’s about precise communication, legal compliance, and fostering great client interactions. Professional invoices reflects on your business and shows your commitment to the clients.

Send invoices for free