Once you’ve created an invoice, you can’t edit or delete it. Here’s what to do if you need to edit an invoice.

Let’s use an example to explain how to fix a mistake on your invoice: You’re a photographer, and you’ve taken photographs at a wedding. You agreed on a package price of 2 500 dollars and a payment deadline of net 14 days.

What is net 14 days?

Payment terms specify how and when you want your clients to pay you. There are many payment terms to choose from. You can get paid in advance, paid upon the delivery of a product or service, or you can use what we call net days to specify when you want your client to pay.

Net 7 days is 7 days after the invoice was issued. Net 14 days is 14 days after the invoice was issued. Read more about payment terms.

When you go to create the invoice, you set the price as 3 000 dollars. You send that invoice to your client via the invoice software. Then you notice your mistake.

What then?

See also: I’ve made an invoice mistake, what do I do?

Why can’t I edit the invoice?

It would be easiest if you could just amend that invoice to say 2 500 dollars, but you actually can’t.

When you make an invoice it should be assigned a unique number, either using pre-numbered invoice pads or using invoice software. There cannot be any gaps in the sequence.

You can’t edit your invoices once they’ve been assigned a number, otherwise people could make their income seem higher or lower, or reduce taxes.

That’s because invoices are used to figure out how much to pay in taxes and they form the basis of your bookkeeping. And if you were to be audited, you’d have to provide all your invoices as part of your sales documentation.

How to fix pricing errors on an invoice

Instead of editing the invoice or deleting the invoice, you cancel it out by creating what’s called a credit note. The credit note looks exactly like an invoice, but has the word ‘credit note’ at the top.

In the example of the photographer’s invoice, you’d have to create an invoice that looks exactly the same as the invoice with errors on it, but enter the amount as – 3 000 dollars. This cancels out the invoice, so that the client owes you 0 dollars.

Then you can create a new invoice—with the next number in the sequence—for 2 500 dollars.

If you’ve created an invoice for too low an amount, you can either credit the invoice and issue a new one, OR you can create another invoice for the remaining amount. That saves you having to credit the first invoice. Whatever you choose, make sure to communicate clearly with the client, so that you maintain a good relationship.

If you’ve sent the erroneous invoice to the client, send the credit note too

They’ll need it for their own record, to show that the 3 000 dollar invoice was cancelled, and it’s also a sign of professionalism on your part.

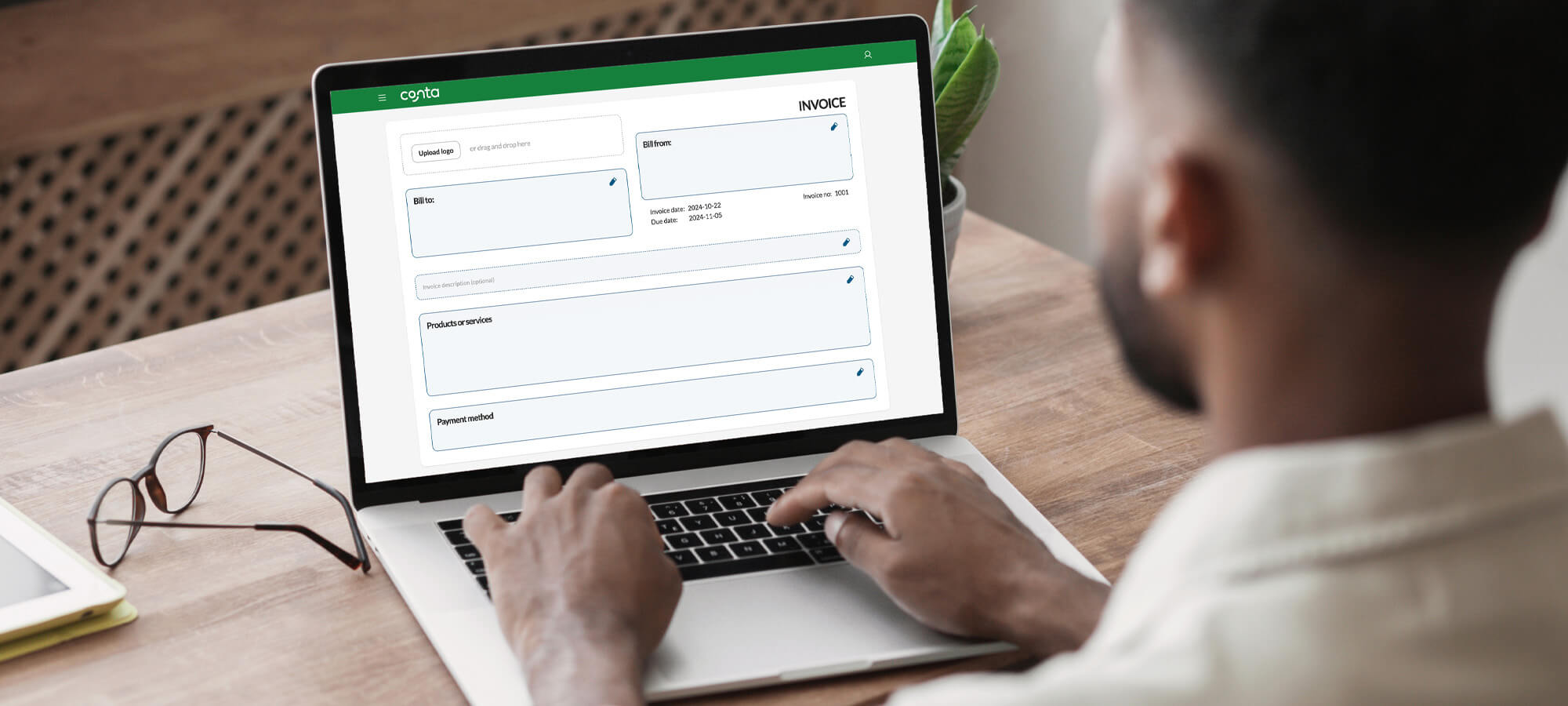

This is how to make a credit note when you use the free invoice software Conta.

What about other mistakes?

In some cases, it might be enough just to talk to the client to clear up errors. For example, if you put the wrong due date on the invoice, you can communicate with the client, preferably in writing, to confirm the correct due date.

Make sure to adhere to this due date: Don’t send the client payment reminders too early. This can damage your customer relationship.

On the other hand, if you’ve entered the wrong payment details, it’s probably a good idea to send the client another invoice—so you don’t miss out on the payment.

In short: In any case where you have to, or want to, send the client an updated invoice, you have to credit the first invoice and create another invoice.