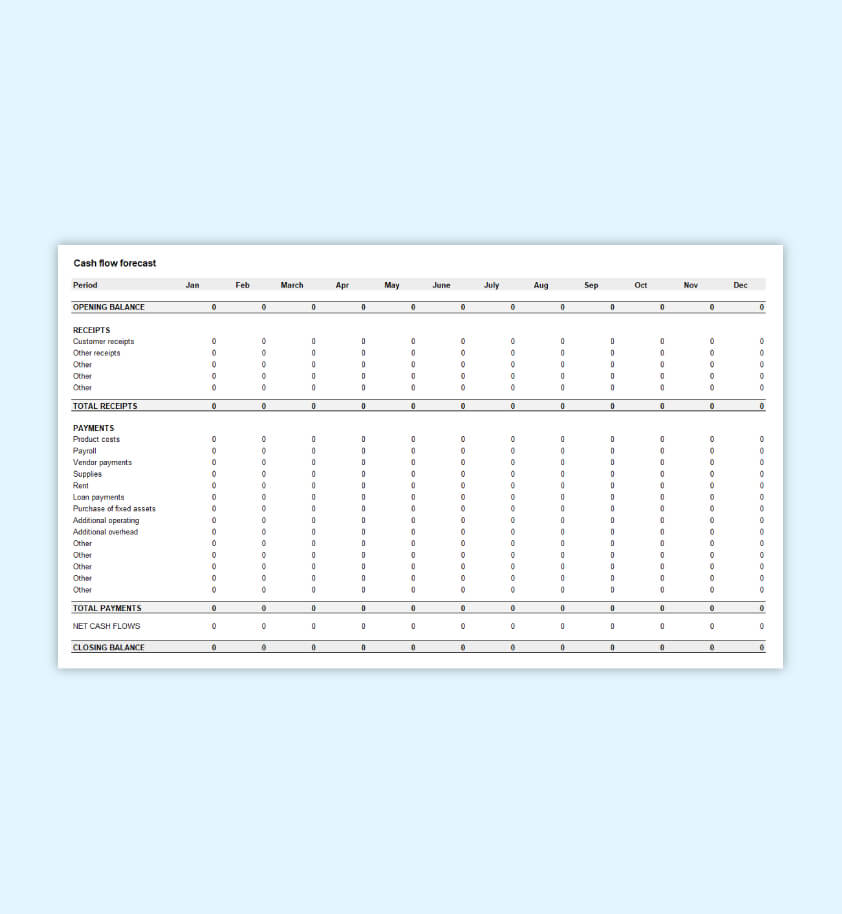

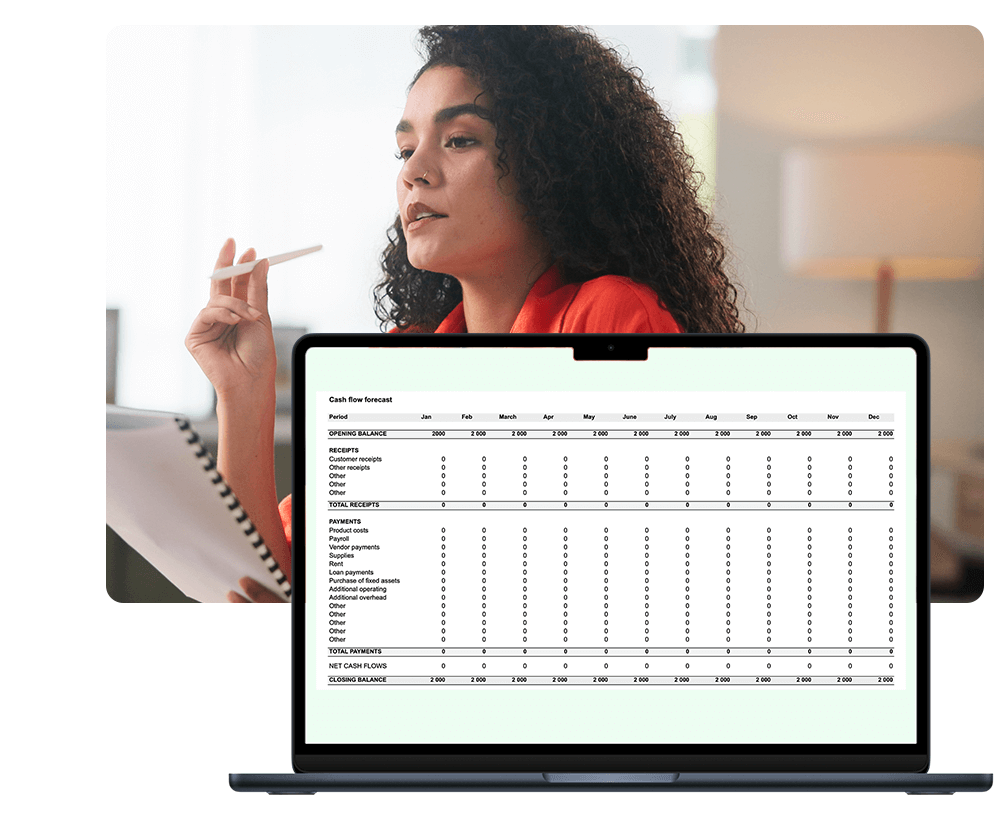

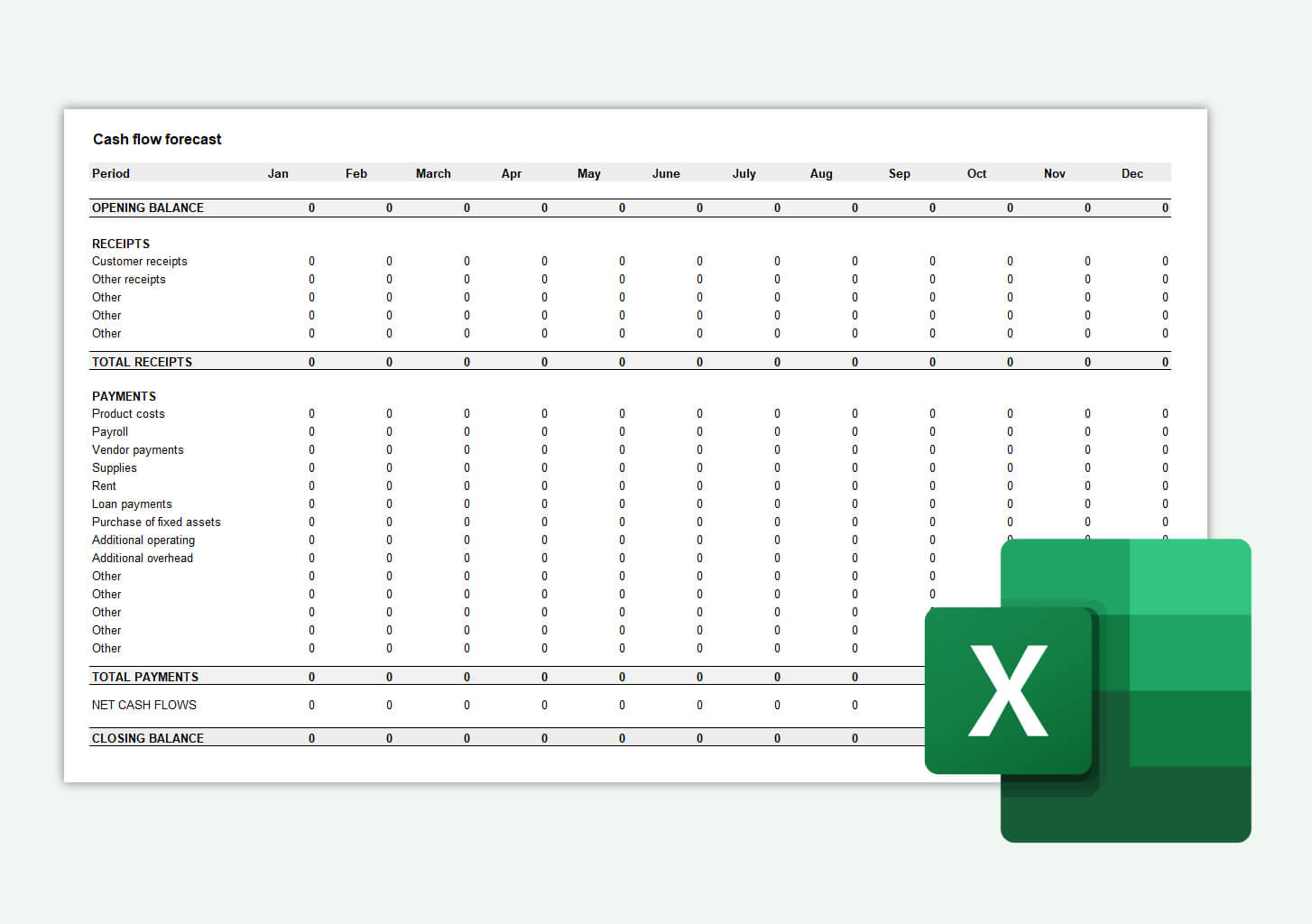

What is a cash flow forecast template?

A cash flow forecast template is a budget that businesses use to estimate how much money will be coming into their business and flowing out of their business over a period of time.

This shows whether your business has enough cash to cover upcoming payments.

4.5 on Google

4.5 on Google