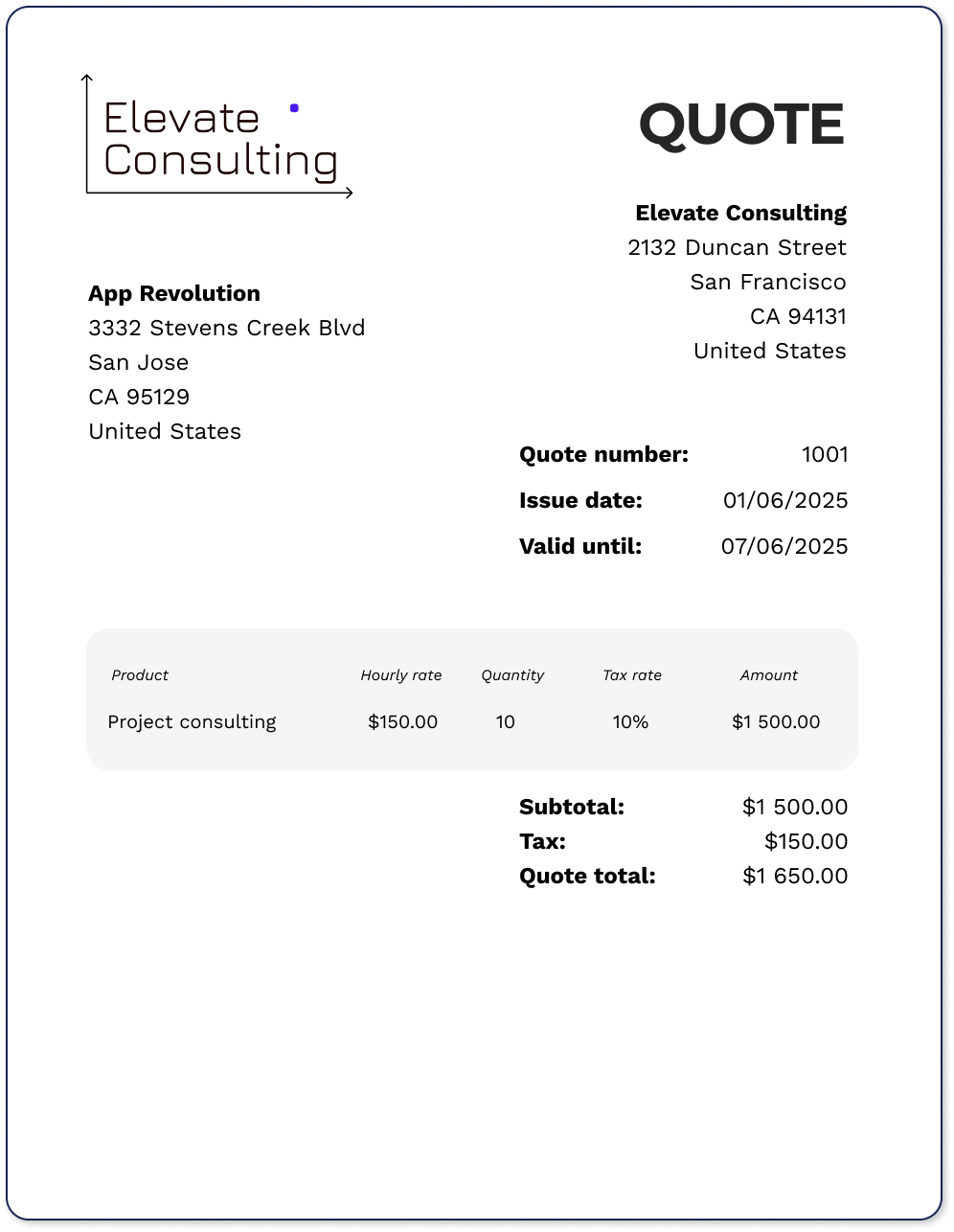

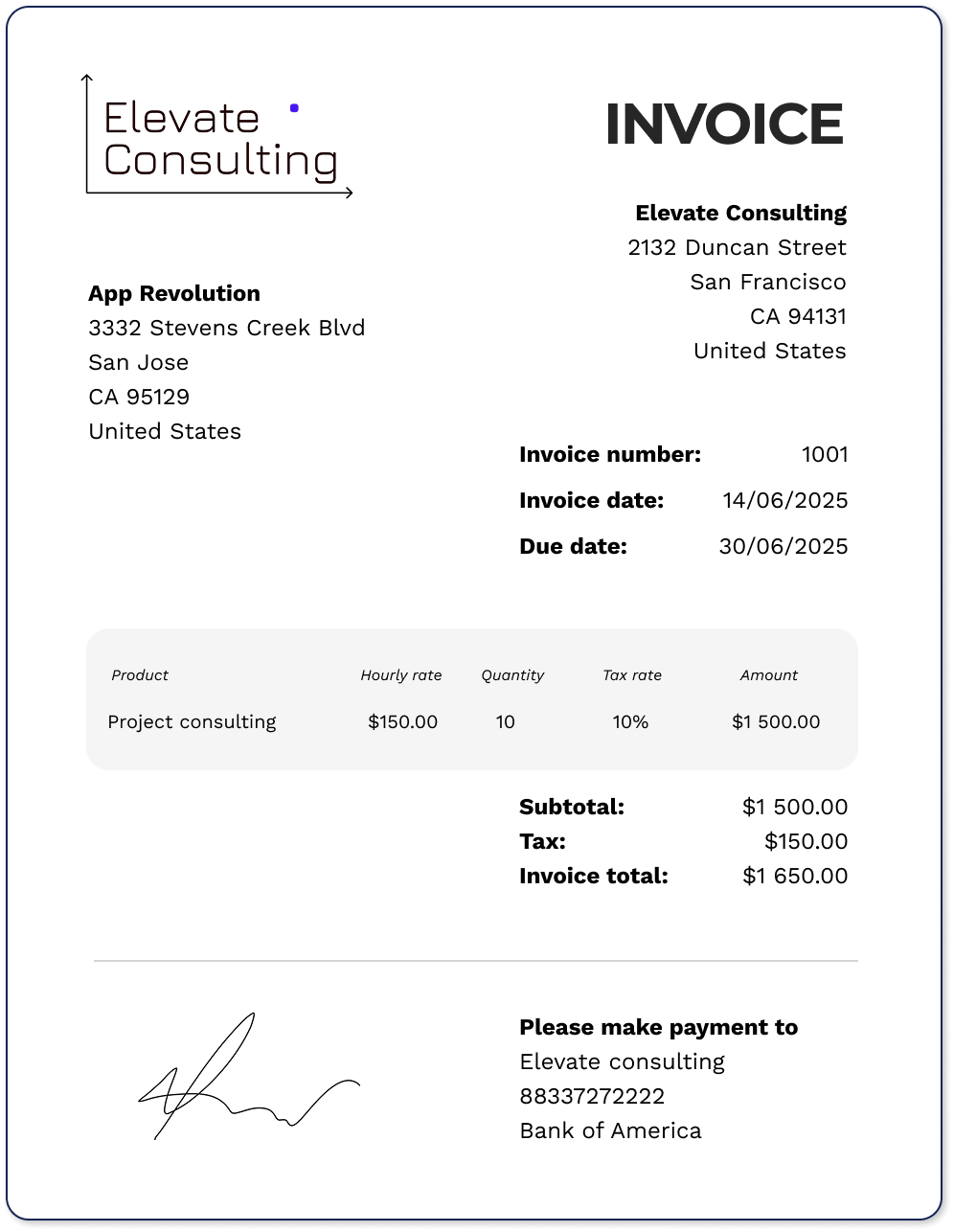

What is an invoice? An invoice is a document—either printed or in PDF form—that shows that a sale took place and tells the buyer how and when to pay you. An invoice should include all the information the buyer needs to pay you, such as prices, taxes, payment instructions, and due date.

Is an invoice a bill or receipt? The phrases invoices, bill, and receipt are sometimes used interchangeably, but they’re different types of documents.

A bill is a simplified invoice provided at the point of sale, for example when you ask to pay at a restaurant. You’ll be given a bill that shows what you ordered, then once you’ve paid, you’ll be given a receipt.

A receipt documents that payment was made. If you purchase something in a shop and pay with card or cash, you’ll get a receipt to show that you paid.

An invoice shows that something was sold, but that payment has not yet been made. The invoice asks for payment and shows the buyer how to pay, for example via bank transfer.

What is an invoice in simple words? The most simple way to explain an invoice is that it’s you asking for payment from the person or company who’s purchased goods or services from you.

The invoice should show what you sold, and have clear instructions for how to pay.

What is the difference between a bill and an invoice? A bill is a simplified invoice that you get at the point of payment. The most common example is the piece of paper you get at a restaurant before you pay with card or cash. After you’ve paid, you get a receipt.

If you sell goods and services, you should invoice your clients to get paid.

Are invoices usually sent just after a sale? Usually, yes, but there are some exceptions. If you have a long-term contract with a client, you might send invoices on a monthly basis, rather than just after you’ve worked some hours for them.

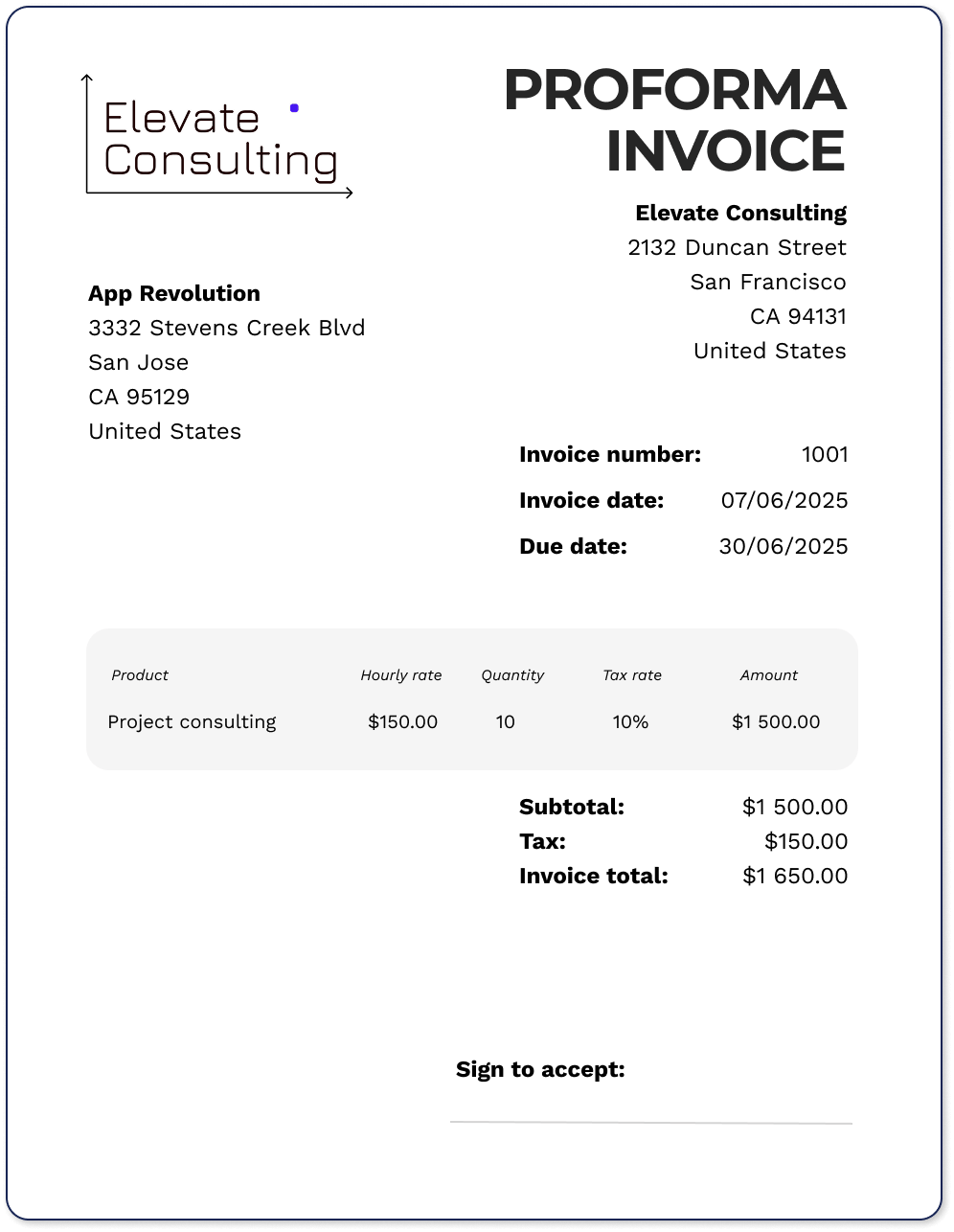

In some cases, you can also agree to an upfront payment, in which case you can invoice before you provide the goods or services.

What’s an invoice used for? The most important reason for sending invoices is to get paid, but invoices are also important to document sales, to correctly do your bookkeeping and file taxes, to get an overview of your business, and to operate as a professional business.

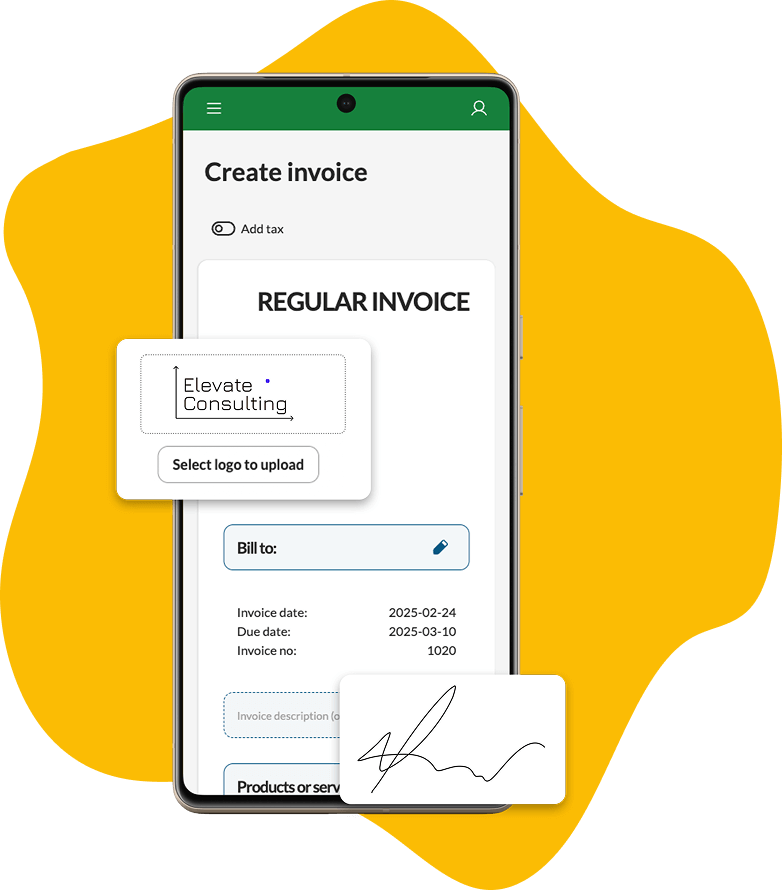

What does it mean to make an invoice? When you make an invoice, you’re creating a document to ask the buyer for payment. The invoice can be made with pen and paper, using invoice pads—but more commonly they’re made online using invoicing software.

What does an invoice usually include? The invoice should include information about the buyer and seller, the products or services that were sold, as well as payment instructions. Read our article Invoicing 101.