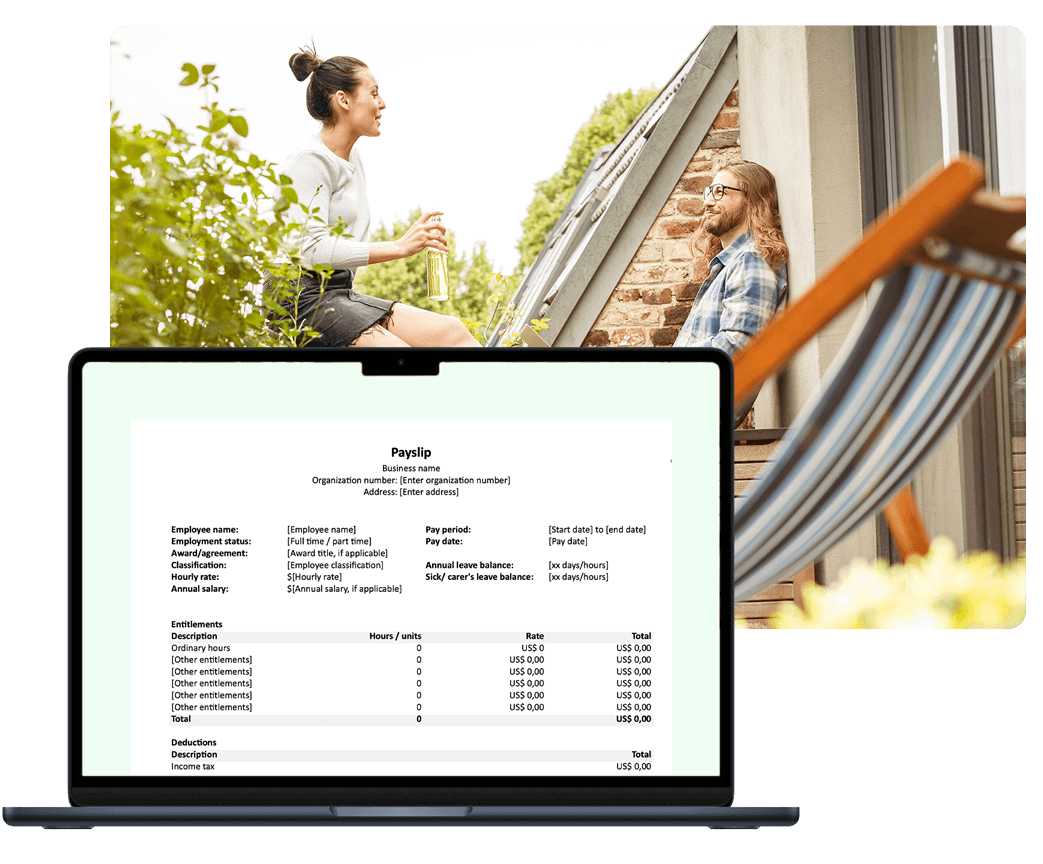

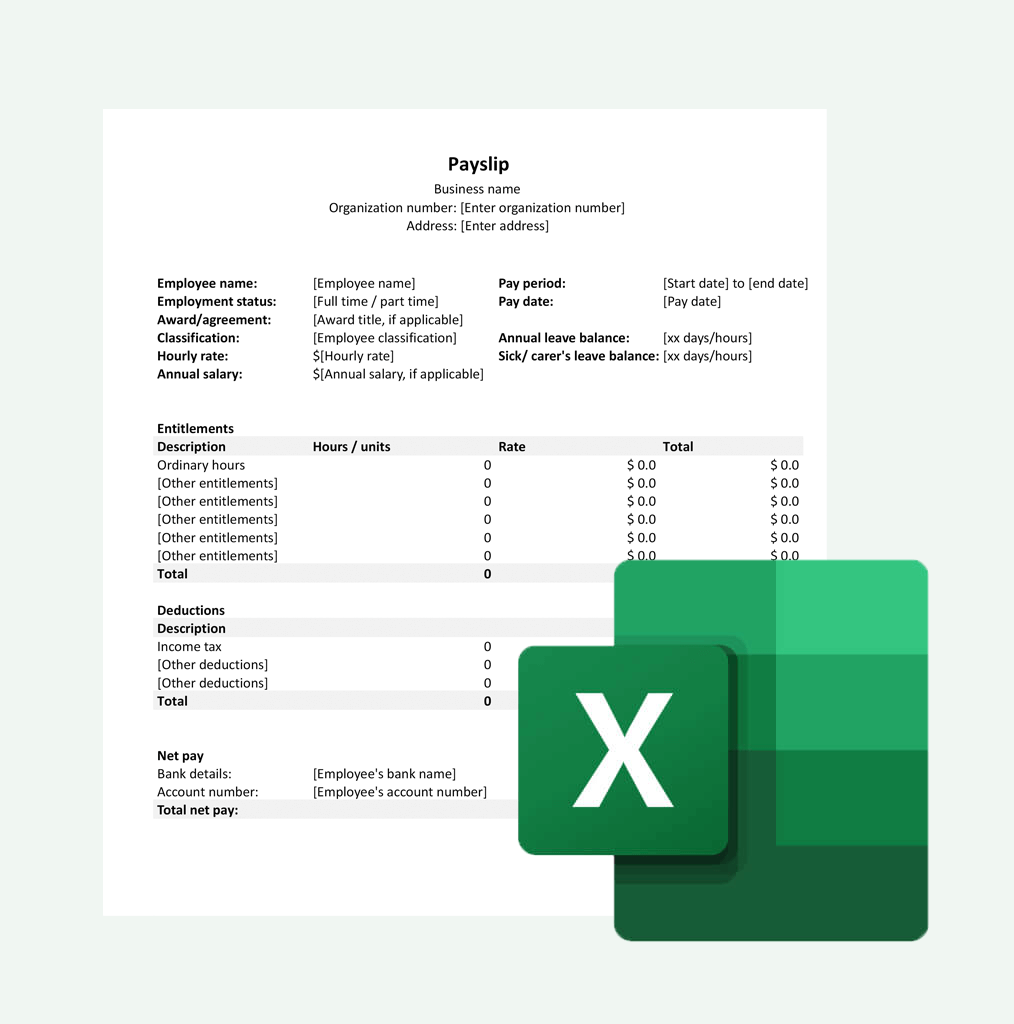

What is a payslip?

A payslip is a document that you have to send your employees when you pay their salary. The payslip shows how much the employee made, when the salary was paid, and any other details concerning their pay. It can also be called a paystub or salary slip.

The payslip is important because

- you’re legally required to provide employees with payslips

- it serves as proof of employment

- employees can use it when applying for housing, opening a new bank account, or getting a credit card

4.5 on Google

4.5 on Google