What is a cash flow statement?

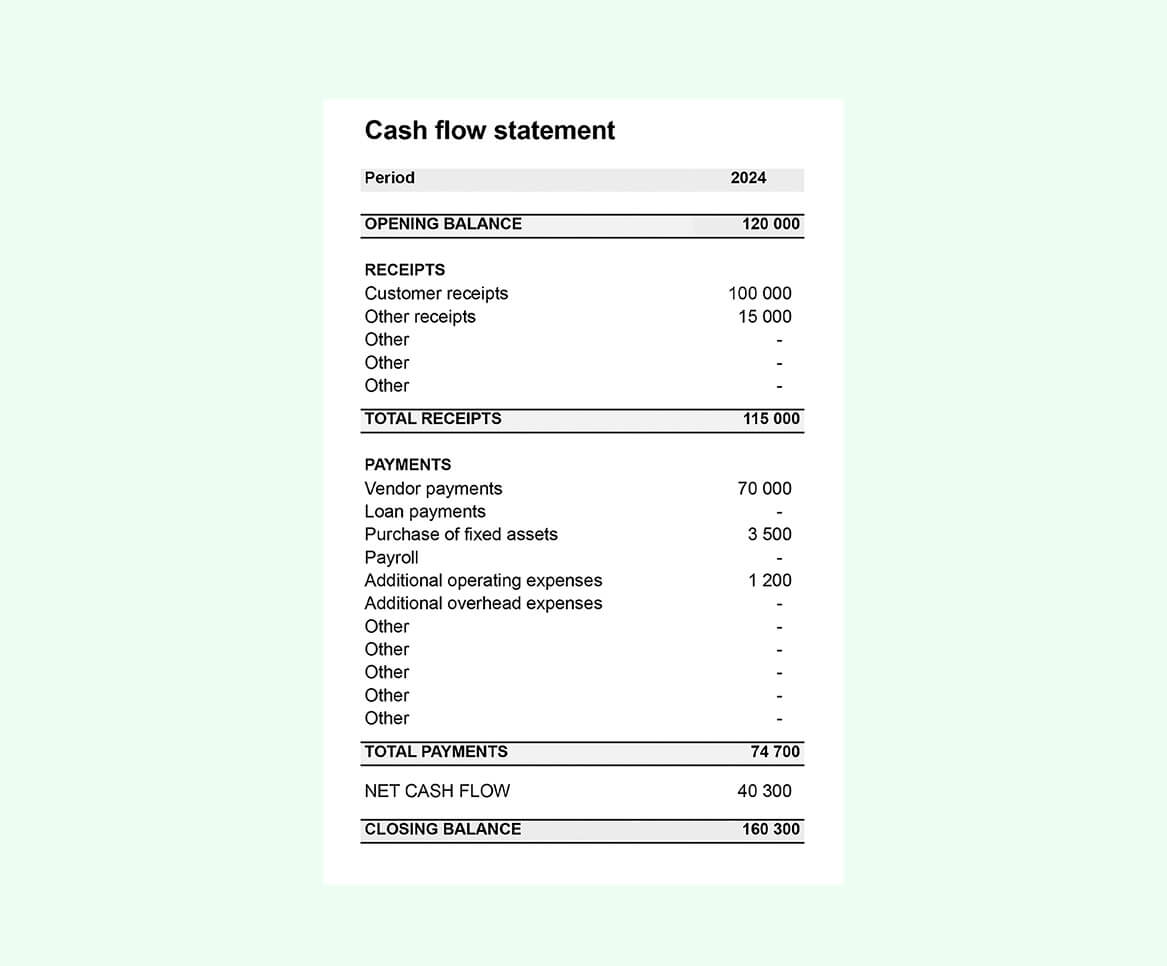

A cash flow statement is a financial report that shows how much money your business received and spent over a period of time. This stream of money in and out is called cash flow.

The goal of the cash flow statement is to see whether your business has good liquidity, in other words, to see how your income and expenses stack up against each other.

A cash flow statement reviews numbers from the past month, quarter, or year, while a cash flow forecast predicts cash flow in the upcoming month, quarter or year.

4.5 on Google

4.5 on Google