New to invoicing? Here are 10 common mistakes you should avoid when you want to invoice correctly, get paid fast, and stop worrying.

Why do invoicing mistakes happen?

If you don’t get paid for your work, your business won’t survive long. Yet, many businesses make invoicing mistakes which causes delayed payments—or even loss of money.

These mistakes happen because businesses rush their invoicing, don’t know enough about invoicing, or use the wrong tools.

Luckily, it’s pretty easy to avoid the most common invoicing mistakes. Let’s take a look. 👇

10 of the most common invoicing mistakes

1. Invoicing late

This is a classic. Once you’ve sold something, you really should invoice immediately. It makes sense, doesn’t it? The sooner you invoice, the sooner you can get paid. You also don’t want the client to forget all about you—and they certainly won’t chase the invoice if you forget to send it.

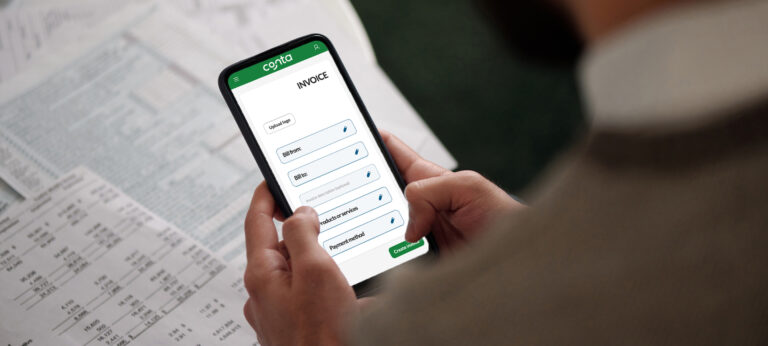

So why not save yourself the stress and invoice regularly—there are even mobile apps so you can do your invoicing on the go.

2. Errors on the invoice

You should check the invoice before you send it. Among other things, you should make sure that your details are correct, that the due date is correct, and that you’ve included all the products and services you’re charging for.

This is how to write an invoice.

It’s a good idea to get things in writing when you talk with the client, so that you can go back to the email thread if you forget the nitty gritty details of the transaction.

3. Invoicing the wrong client

It doesn’t matter that all the details are correct, if you send the invoice to the wrong person. Make sure to invoice the right client, otherwise you risk seriously damaging your reputation, getting paid late, and missing out on repeat purchases.

If you have a lot of clients, it might be worth investing in a CRM system, so that you can keep track of all the transactions.

4. Lack of professionalism

A general lack of professionalism is not a great look for your business. You don’t want your invoices to look like they were made in MS Paint. Make sure to use a professional-looking template—or invoicing software to make your invoices, and don’t forget to upload your logo. This is all part of building a strong brand.

Another way to appear professional is to send out well-spoken emails, follow up in a timely manner, and act polite towards the client.

See also: How to make a professional-looking invoice

5. Hidden fees

Don’t add hidden fees to your invoice. Any additional fees should be communicated to the client before they make the purchase. If you’re planning on charging fees for late payments—for example 1 or 2%—you have to inform the client on the payment section of the invoice.

They’re not gonna appreciate any surprises when it comes to payments.

6. Unclear payment terms

Speaking of payments, make sure that the clients know your payment terms ahead of the purchase. Do they have to pay upon delivery? Do you only offer one way to pay? Do you have 14 or 30 days payment terms? Are there late fees for late payments? What kind of cancellation policy do you have?

These are all questions you should answer so that the client is not confused or unhappy with the purchasing process. You want to avoid disputed invoices.

7. Wrong tax rate

Tax is difficult. Full stop. When we talk to our customers, tax is always mentioned as one of the most difficult things about running a business or being a freelancer or contractor.

In general, most countries require you to register for tax—such as VAT or GST—when you reach a certain threshold, or when you think you’re likely to reach it in the near future. Once you’re registered, you should invoice with tax.

The tax rate varies from country to country, and some countries have different rates for different products and services. If you’re unsure we recommend reaching out to a tax advisor or to the tax administration in your country.

8. No backup of your invoices

Invoices are important business documents, and as such you should always store them somewhere safe. If you make invoices in Excel or Word—or if you use pen and paper— you should back up your invoices in the cloud. You’ll need them when you do your taxes and your bookkeeping, and you have to show your invoices if you’re ever audited.

If you use invoicing software, the invoices will be stored safely for you.

9. Sending invoices in the mail

Sending invoices in the mail isn’t necessarily a mistake per se, but it does take a lot longer than sending via email or via Whatsapp. That mistake can mean bad news for your cash flow. It also increases the chance that your client is surprised by your invoice, since a lot more time will pass between the transaction and the invoice.

If you send invoices in the mail, you probably have to have a slightly longer due date—if you only give the client 7 days to pay and the invoice takes 3 days to reach them, that’s not a great customer experience. Having an extended due date obviously means it’ll take longer to get paid.

We’ve collected 7 tips to get paid fast.

10. Forgetting to follow up

Once the invoice has been sent, it’s important to follow up on it. First of all, you should send a nice email to the client, along with the invoice. Secondly, once the due date arrives, you should send a polite reminder to bump your invoice to the top of the pile. They might have simply forgotten about it.

If the invoice still doesn’t get paid, reach out to the client to figure out what’s causing issues.

Handling overdue invoices in a good way, is important to get paid and to ensure a good customer relationship.

What do these invoicing mistakes cost?

Invoicing mistakes can lead to big losses, and it can take a lot of time to correct. A study of Nordic businesses revealed that it took an average of 31 days to correct invoice mistakes. That’s a lot of billable hours down the drain.

Besides the financial costs, invoicing mistakes also affect your business’ reputation and image. Your clients aren’t gonna leave positive reviews, refer others, or purchase from you again if you make grave invoicing mistakes.

If you’re ready to improve your invoicing, you can start using free invoicing software today. We’ve compared invoicing in Excel versus invoicing with invoice software.

Create invoices for free