Whether you are a first-timer creating invoices or you’ve been in the game a long time, it’s important to understand how to write an invoice correctly. In this guide, we’ll show you how to create a professional invoice that will help you get paid on time.

You’ve set up a business and sold some products or services. It’s time to send your first invoice! But how do you do that?

In this guide, you’ll find everything you need to know about invoicing and a step-by-step guide on how to write your first invoice.

We’ll also give you some free tools that makes the process easy, as well as some tips on how to increase your chances of getting paid on time.

What is an invoice?

An invoice—also referred to as a bill—is a document issued by an individual or a business to request payment from a client.

The document describes what the client has purchased and how you want to get paid. It also includes details such as your name and contact information, a description of the goods or services you’ve sold, prices, and other payment information.

Some people believe that invoices and receipts are the same things.

That’s not the case: An invoice is a document asking for payment, while a receipt is a document that proves that a payment has already been made.

For example, if you go grocery shopping, you get a receipt after you pay at the till, either with cash or with card. If an electrician does a job at your home, you’ll receive an invoice for the work they’ve done, that you then have to pay, via for example bank account transfer or PayPal.

See also: Invoice vs. receipt: What’s the difference?

What are the different types of invoices?

The most common type of invoice is a sales invoice, which is used to request payments from clients.

In addition, there are other types of invoices, such as:

- Proforma invoice: A preliminary invoice used to confirm the details of a sale before the goods or services are provided.

- Recurring invoice: Invoices issued on a regular basis, such as monthly or annually.

- Past due invoice: When an invoice hasn’t been paid on time, you can resend the invoice to the client. This is called a past due invoice. Sometimes it includes additional charges, but you should make sure to mention this in your contract, on your proforma invoice and on the original invoice. If you surprise the client with additional fees, it can damage your relationship with them.

- Credit note: A credit note is used to void the original invoice, usually because there were errors on the original invoice. If you’ve sent the client an invoice with the wrong amount, you first have to credit that invoice—and send the client the credit note to prove the original invoice has been voided—and then issue another invoice with the correct amount.

Download free invoice templates and get started today.

What to include when you write an invoice: A brief checklist

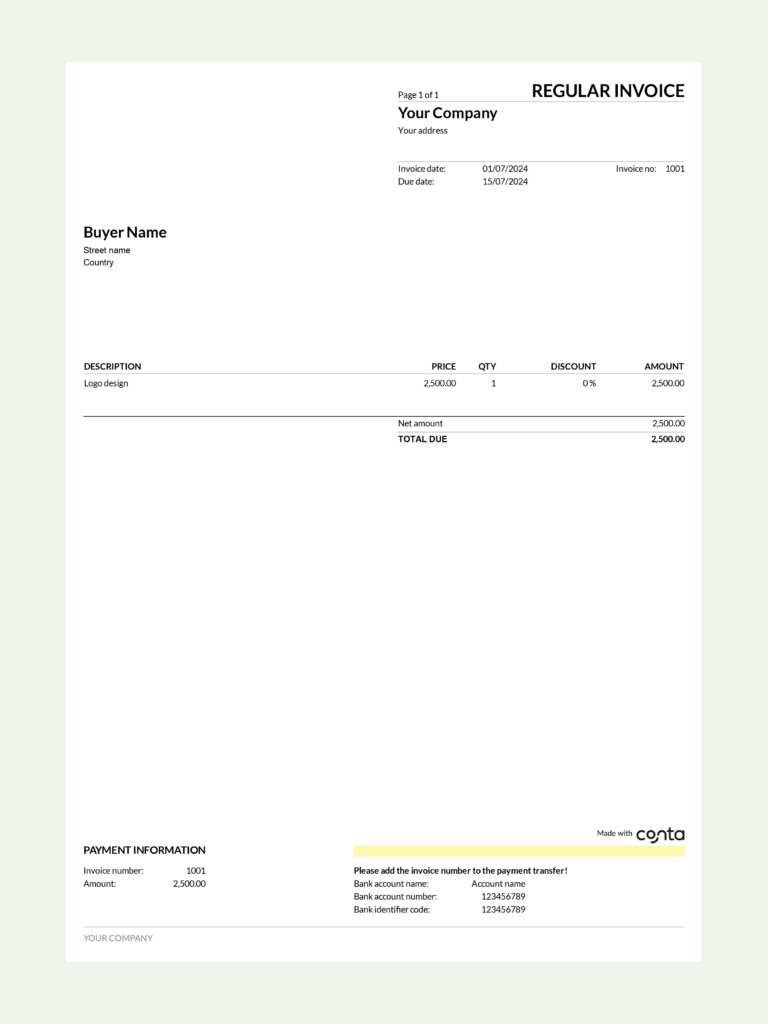

These are the most important elements to include when you make an invoice:

- A unique invoice number

- Business information including your business name, address, phone number, and email

- The name, address, phone number, and email of the client you’re invoicing

- The invoice date

- The due date

- A description of the goods and services you’re billing the client for

- The amount due

- Payment terms

- VAT or GST, if applicable

Write an invoice, step by step

1. Make your invoice look professional

Using a spreadsheet or invoice software, you can write an invoice that looks professional, preferably with your company logo too.

Remember to clearly mark your invoice with the word invoice, to improve the likelihood of getting paid on time.

See also: How to build a strong brand for your startup

2. Include company name and important information

Make sure that the client knows who sent the invoice. Also make sure to include the client’s information on the invoice. In most countries, this is required in order for the invoice to be legally valid.

Pro tip: Invoice software helps you remember it all

Invoice software, such as Conta, helps you ensure that you include all the necessary information when you create invoices. Conta is completely free to use—try it today.

3. Remember to add dates

Dates act as as a point of reference in your bookkeeping and in your invoice follow-up. You should include these dates:

- The date the invoice was issued, usually called invoice date

- The payment due date

Also, make sure to mention that late fees will occur if payment is not received on time.

4. Include a breakdown of the costs

Make sure that the clients knows what they are paying for by breaking down the costs: List the services or products you’ve provided, along with their quantity and unit price.

Next, you will need to include the sum of the products and services without tax and discounts, any discounts, VAT or GST, and the net total.

If you are using invoicing software, these calculations are done automatically.

5. Save and send the invoice

There are several ways to make sure that an invoice gets to your client:

- Email: You can send the invoice to the client’s email. This is a fast and convenient option, but there’s a risk that the invoice ends up in the client’s spam folder.

- Postal mail: You can also send the invoice in the mail. This will appear more formal and professional, but it’s also slower and more expensive.

- WhatsApp: In some countries invoices are shared via WhatsApp or similar, because email isn’t as popular or widely used. This is a quick way to send invoices.

- Online invoicing software: You can use online invoicing software to create and send invoices to your clients. When you use software, you can track the status of the invoice, and set up recurring invoices and automated payment reminders.

What to do when clients don’t pay on time

Clients paying late is not a one-off, in fact in the US 55 percent of invoices are paid late. That’s why it’s important to have routines in place to follow up on your invoices.

If a client doesn’t pay on time, there are some steps you can take:

- Follow up with the client: A polite reminder email or phone call might be enough to get the client to pay.

- Charge late payment fees: If you’ve specified late payment fees on the invoice, you can add this fee when you resend the invoice.

- Consider offering a payment plan: If the client is unable to pay the full amount by the due date, you might be able to work out a payment plan to help them pay the invoice in installments.

- Take legal action: If the customer refuses to pay the invoice, you can consider taking legal action. This may involve hiring a lawyer or taking the client to small claims court.

By following these steps, you can help ensure that you get paid on time and avoid issues with your cash flow.

See also: The ultimate guide to liquidity and cash flow

Best practices for invoicing

- Use a professional template: A well-designed invoice not only looks more professional, but also helps to clearly communicate the details and the payment terms. You can use a template or invoicing software to create professional invoices. This also helps you build a strong brand.

- Use clear and concise language: Avoid using jargon or technical terms that your client might not understand. Use simple and straightforward language to clearly communicate the details of the invoice.

- Set clear payment terms: Specify the due date for payment and any late fees that apply. You might also want to include information about your preferred methods of payment, for example via bank transfer or PayPal.

- Follow up on overdue invoices: If an invoice becomes overdue, it’s important to follow up with the client in a timely manner. This can be done through email or via the phone. Be polite but firm, and try to resolve any issues that may be preventing payment.

By following these best practices, you can improve your chances of getting paid on time and streamline your invoicing process.

Pro-tip: Get notified about overdue payments

The free invoicing software from Conta will let you know when a payment is overdue. That makes it easy to follow up with your clients and get paid quicker. Create, send and manage your invoices easily, all in one place.