What do I use the budget template for?

Categorize your expenses

Once you have your list of expenses, you can categorize them into essential and non-essential costs.

Essential costs are necessary to run and expand your business, such as payroll, rent, utilities, and raw materials. Non-essential expenses, on the other hand, are not required and can include things like marketing campaigns, travel, or PR costs.

Prioritize essential expenses and carefully evaluate your non-essential costs, to make sure all your money is going towards reaching your business goals.

Set financial goals

With a clear understanding of your revenue streams and operating expenses, it’s time to set financial goals for your business. These goals could include increasing sales revenue, reducing operating costs, improving profit margins, or expanding into new markets.

Be specific, and include measurable targets and timelines for your goals.

Allocate your resources

Now that you have a clear picture of your revenue and expenses, it’s time to allocate your resources accordingly.Start by covering your essential operating expenses to ensure that your business runs smoothly.

Then allocate funds towards your financial goals, whether it’s doing marketing activities, expanding your product line, or upgrading your infrastructure.

Track your spending

Creating a business budget is only the first step; effectively managing your finances requires you to continually monitor and track your spending.

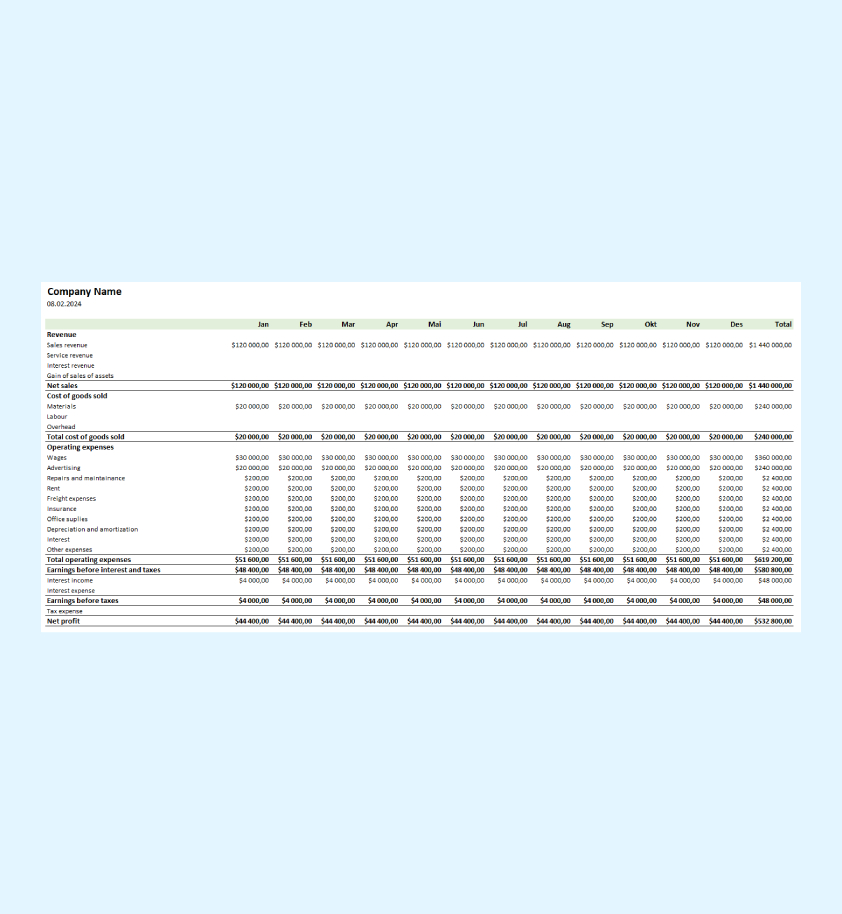

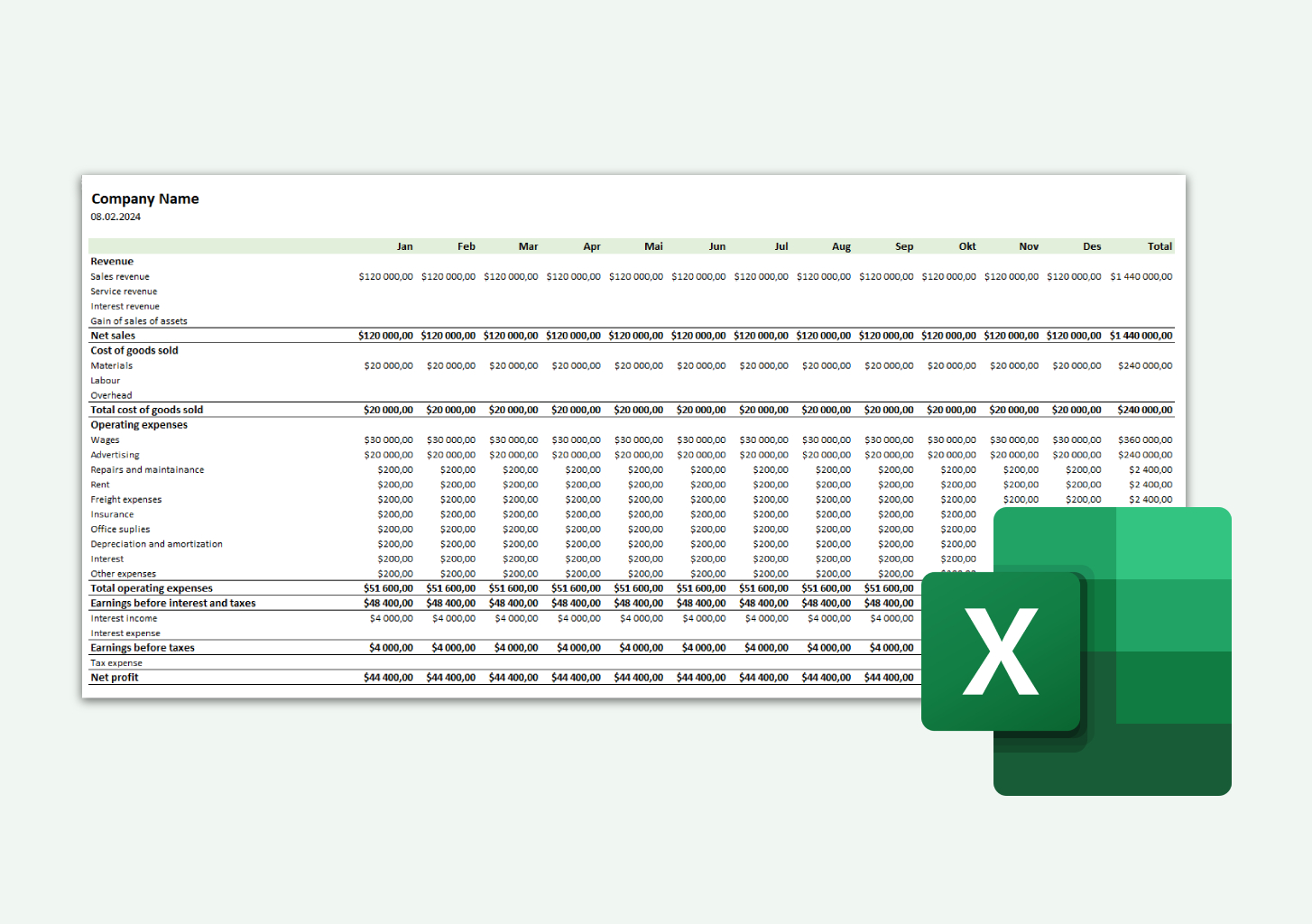

Use accounting software or budgeting tools to track your income and expenses and compare them against your budget. Try to identify areas where you may be overspending or underspending, and make the necessary adjustments to stay on track towards your financial goals.

4.5 on Google

4.5 on Google