How you send your invoices can influence how quickly you get paid. This will impact the overall cash flow of your company. In this guide, we’ll take a look at how to send an invoice.

Sending invoices is an important part of being a freelancer, contractor or small business owner, and means you can get paid for the products or services you provide.

However, the invoicing process can sometimes seem daunting, and mistakes can lead to payment delays.

We’ll guide you through the invoicing process, give you valuable insights on the most effective delivery methods, as well as which tools work best for you.

What is an invoice?

An invoice is a document generated by a seller to request payment from a buyer for goods or services.

An invoice is a detailed record of the transaction, specifying which products or services were provided. An invoice is also a legally binding request for payments, specifying the amount due, the due date, and the payment terms.

Send invoices for free with Conta

Say goodbye to the hassle of invoicing. Conta streamlines the process, and you can create invoices in under 2 minutes. Just enter your clients, products and services and prices. Start sending professional invoices now.

What to include in the invoice

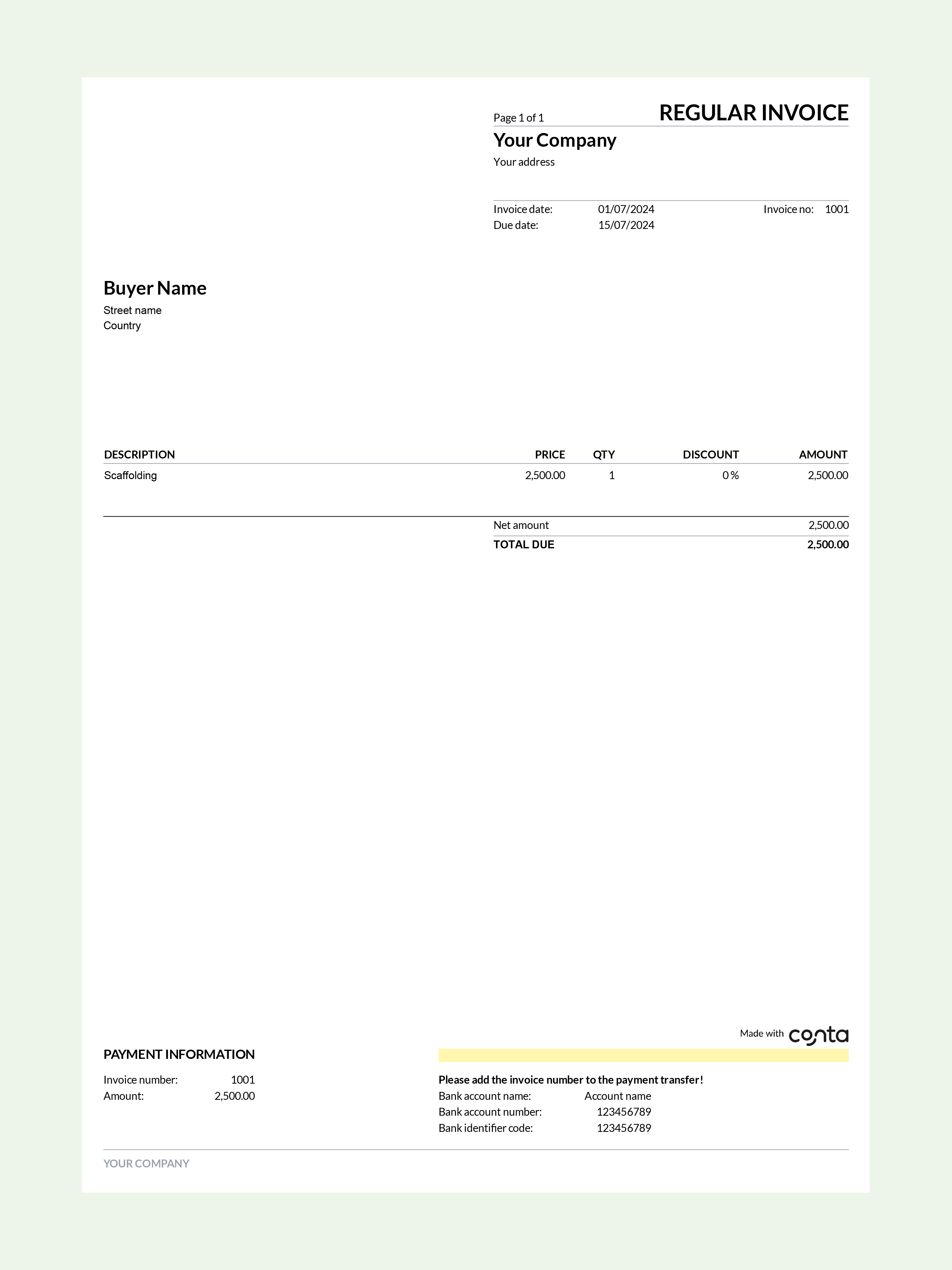

This is what you have to include on an invoice:

- The word “invoice”

- A unique invoice number

- Your business information, including organization number

- Contact information for your client

- The date the invoice was made

- A list of goods or services, including quantity and price

- Tax, if applicable

- Discount, if applicable

- The due date for payment

- Payment terms

When to send an invoice

Typically, you send an invoice after you’ve delivered the products or services. We recommend sending the invoice immediately. That way you won’t forget and you’ll most likely get paid quicker.

There are also some situations where you can invoice before delivering products or services, for example if

- you have to buy a lot of materials to perform the service. In that case, asking for upfront payment ensures you have the necessary funds.

- a client has a track record of delayed payments. Invoicing in advance means you avoid the risk of your client paying late or not paying at all.

- you and your client have agreed on a discounted price for upfront payment.

How to create invoices

Invoices can be made in several ways. Among the most popular methods are invoice templates and invoicing software.

Invoice templates

Invoice templates are pre-designed layouts, available in formats such as Word, Excel, and PDF. Invoice templates let you quickly and easily create, edit, and customize invoices.

Get started with a free invoice templates.

The benefits of invoice templates:

- An easy way to get started with invoicing

- Templates can be tailored and customised to align with your brand

- Templates are usually free

The downsides of invoice templates:

- You have to fill out all the fields manually and for Word and PDF, you have to calculate tax and discount yourself

- It’s easy to make mistakes

- It’s more difficult to manage your invoices, follow up on outstanding payments, and make credit notes

Invoicing software

Invoicing software is made for creating professional invoices, managing payments, and keeping track of products and services. With invoicing software, you can set up automation and streamline invoice follow-up.

Benefits of invoicing software:

- Automated calculations, recurring invoices, and payment reminders.

- Real-time tracking of payments

- Efficient record-keeping and easy access to financial data

Limitations of invoicing software:

- There’s usually a cost associated with invoice software

- It might take more time to set up and learn how to use it

Use free and easy-to-use invoicing software

With Conta, you don’t have to worry about costs. It’s 100% free and you can create professional invoices in under 2 minutes. Try it today and save time and money on invoicing.

How to send invoices

Whether you’re making invoices with invoice software or with templates, it’s important to figure out how you’re gonna send the invoices to ensure your clients receive them quickly and that you get paid on time. Here are three options to consider:

1. In the mail

Sending invoices in the mail might seem old-fashioned, but some businesses and clients still prefer this method.

However, keep in mind that the invoice will take longer to reach your client, you won’t be able to verify if it’s been received, and there’s also the possibility that your client’s address has changed.

If you choose this method, make sure allow ample time for the invoice to be delivered, and consider checking in with your client after a while to see if they’ve received the invoice.

2. Via email

For many business owners, email is the preferred method for sending invoices. It’s both quick and eco-friendly. When sending an invoice via email, it’s normal to include a thank-you message in the body of the email. Attach the invoice in PDF format to make it easy for them to download it.

3. Via invoicing software

Several invoicing software let you send the invoices directly from software. You might send it as an electronic invoice or provide clients with a link that lets them see and pay the invoice online.

What’s the best way to send invoices?

In today’s digital age, many businesses prefer sending via email or via invoicing software, as these methods are cost effective and environmentally-friendly.

Recent studies find that electronic invoicing can save up to 60 percent of your costs and decrease your carbon footprint by nearly 67 percent.

That’s why we recommend using invoicing software, such as the free invoicing software from Conta. It’s completely free, which makes it a good fit as you’re starting out.

See also: 10 questions to consider before choosing an invoice software

How to send invoice emails

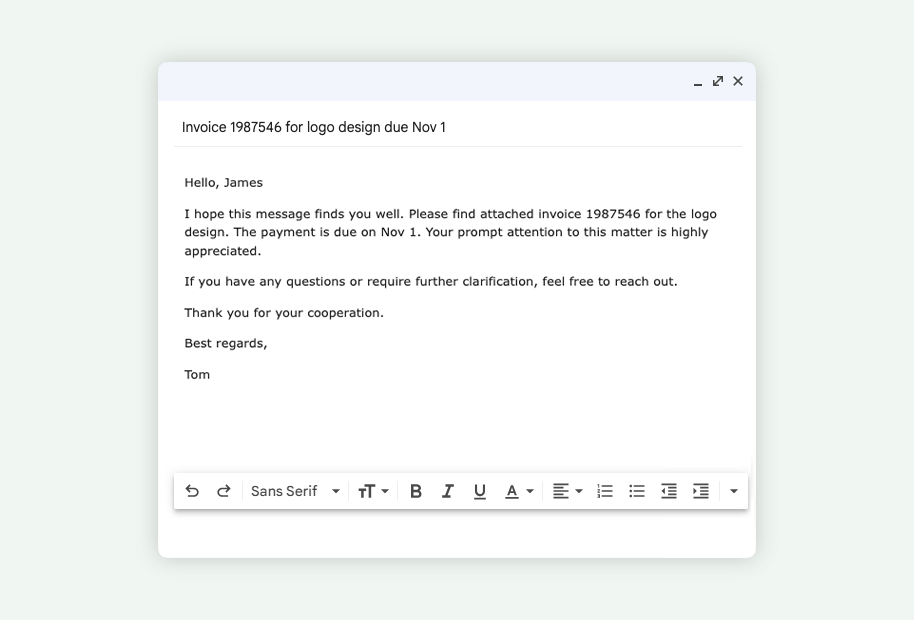

Sending invoices via email makes the billing process quicker. Here’s a step-by-step guide for how to send an invoice via email:

1. Write a clear subject line

Ensure the subject line clearly conveys the purpose of the email, and includes the invoice number and due date. This prevents the email from being overlooked.

2. Attach the invoice

Include the invoice as an attachment. The attachment should be in a common format, such as PDF, so that your client can easily save and print it.

3. Provide invoice and payment details in the email body

In the body of the email, provide a brief and friendly message. Include essential details like your business name, a greeting, and information about the attached invoice. Make sure to maintain a professional tone.

3 invoice email templates

✉️ Standard invoice email

Subject: Invoice [invoice number] for [product/service] due [due date]

Hello, [recipient’s name]

I hope this message finds you well. Please find attached invoice [invoice number] for [product/service]. The payment is due on [due date]. Your prompt attention to this matter is highly appreciated.

If you have any questions or require further clarification, feel free to reach out.

Thank you for your cooperation.

Best regards,

[your name]

✉️ The day the payment is due

Subject: Payment due today – Invoice [invoice number]

Hello, [recipient’s name]

I hope this email finds you well. Today is the due date for invoice [invoice number]. Kindly ensure the payment is processed as outlined in the attached invoice.

If you’ve already processed the payment, you can ignore this email. If you have any concerns or if you require assistance, please don’t hesitate to reach out.

Thank you for your attention to this matter.

Best regards,

[your name]

✉️ One week after the due date

Subject: Gentle reminder – Payment due for invoice [invoice number]

Hello, [recipient’s name]

I hope this email finds you well. Invoice [invoice number], which was due on [due date] is still unpaid. We understand that there might be some obstacles to paying, so we wanted to reach out.

Please review the attached invoice, and let us know if you have any issues or questions. We appreciate your prompt attention to settling this matter within the coming week.

Thank you for your cooperation.

Best regards,

[your name]

✉️ Final notice before sending to collections

Subject: Urgent – Final notice for invoice [Invoice Number]

Hello, [recipient’s name]

Despite previous reminders, invoice [Invoice Number] remains unpaid. As a final notice, we urge you to settle this outstanding payment immediately.

Failure to address this matter within the next [amount] days will leave us with no option but to escalate this to our collections department.

We appreciate your immediate attention to this matter.

Best regards,

[your name]

Invoicing mistakes you should avoid

- Forgetting to specify a due date for payment.

- Forgetting to add all the products or services or not accurately describing what you’ve sold.

- Sending invoices late. This might lead to late payments and make your business appear less professional.

- Not double-checking the recipient details and sending the email to the wrong person.

- Not following up on overdue payments, leading to payment delays.

- Not stating payment terms and conditions clearly on the invoice.

- Not informing the client about late payment fees or interest on delayed payments.

- Not double-checking the details on the invoice before sending it.

Now you know everything you need to know about how to create, send, and follow up on invoices, including how to avoid the most common mistakes. Best of luck with your invoicing!

Create free invoices now