Tax is one of those things everyone dreads dealing with. It can seem impossible to know what to do about tax on your invoice. We’ll walk you through it step by step.

Tax that you add to your invoices is also called consumption tax. This is the tax that you charge your clients, not the income tax that you pay when you file taxes.

Do I have to register for consumption tax?

Let’s start at the beginning: do you even have to register for this kind of tax? In most countries, you have to register for consumption tax—such as GST or VAT—if you reach a certain turnover threshold, or if you expect to reach that threshold in the near future.

The tax administration in your country will have more information about that threshold.

You can also choose to voluntarily register for consumption tax. But why would you do that? Well, there are some benefits for you:

- You can reclaim consumption tax that you’ve paid to your suppliers. You’ll regularly have to tell the tax administration how much tax you’ve paid to your suppliers and how much tax your clients have paid you—if you’ve paid more than you’ve claimed, you’ll get a tax refund.

- It can make your business seem more established. Suppliers and clients will assume this means your turnover is above the threshold. It also shows you can handle the extra administrative work that comes with being registered for consumption tax.

Do I have to put tax on my invoice?

If you’re registered for consumption tax, you have to put tax on your invoice. The only time you don’t add tax, is if you’re selling goods or services that are tax exempt or tax excepted.

Tax exception is for items or services that shouldn’t have tax added to them. If you only sell tax excepted items or services, you can’t register for consumption tax.

Tax exemption is for items and services that shouldn’t have tax added to them, but where you still include a tax rate, but set it to 0%. If you only sell tax exempted items or services, you can register for consumption tax.

It’s a bit difficult to grasp—and what is excepted and exempt varies from country to country—so if you think you may be selling tax excepted or tax exempt goods and services, you should reach out to a professional to get specific advice regarding your business.

How do I put tax on my invoice?

If you’re registered for tax, and you sell products and services that should have tax added, you need to invoice with tax.

The tax rate varies from country to country, and some countries have different rates for different products and services. Again, it’s worth speaking to a professional to find the correct solution for your business.

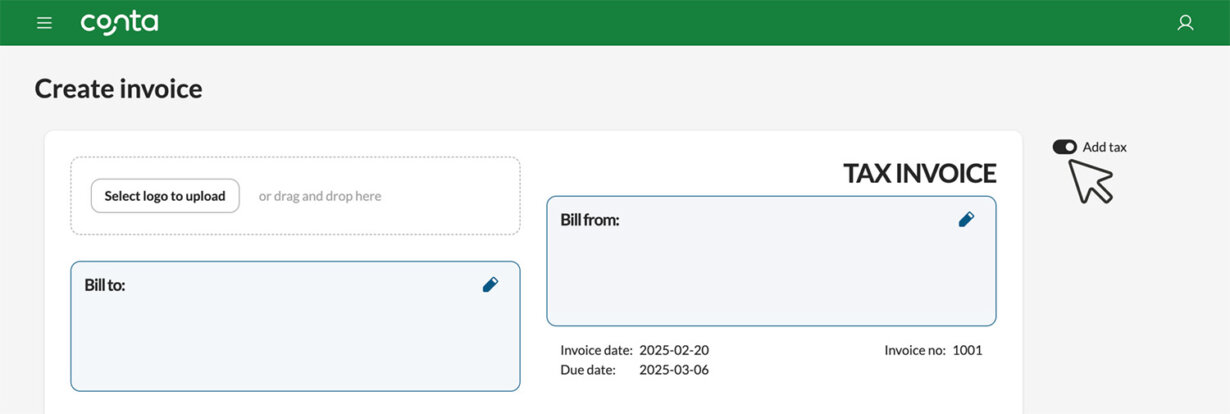

If you use invoice software, it’s as easy as toggling tax invoice, and then choosing the right tax rate for your products and services:

Make sure to set the right rate; invoicing with the wrong tax rate is one of 10 common invoicing mistakes you should avoid.

The tax will be calculated automatically and clearly displayed on your final invoice.

Have you made a mistake on the invoice? This is how to fix an invoice mistake.

See also: VAT and GST rates per country worldwide

What else do I have to do once I’ve registered for consumption tax?

Once you’re registered for consumption tax, you not only have to put tax on your invoice, you also have to inform the tax administration about how much tax you’ve claimed from your clients, and how much tax you’ve paid to your suppliers. How often you have to do this depends on the laws in your country.

If you’ve claimed more tax than you’ve paid, you’ll have to pay the difference. If you’ve paid more tax than you’ve claimed, you get a tax refund.