Why use a consulting invoice template?

As a consultant, you have to bill your clients to get paid for your consulting work. For short-term projects, you can use an hourly rate, while a flat fee might be better for larger projects. Some consultants even work on a retainer basis, billing for a set number of hours or services per month.

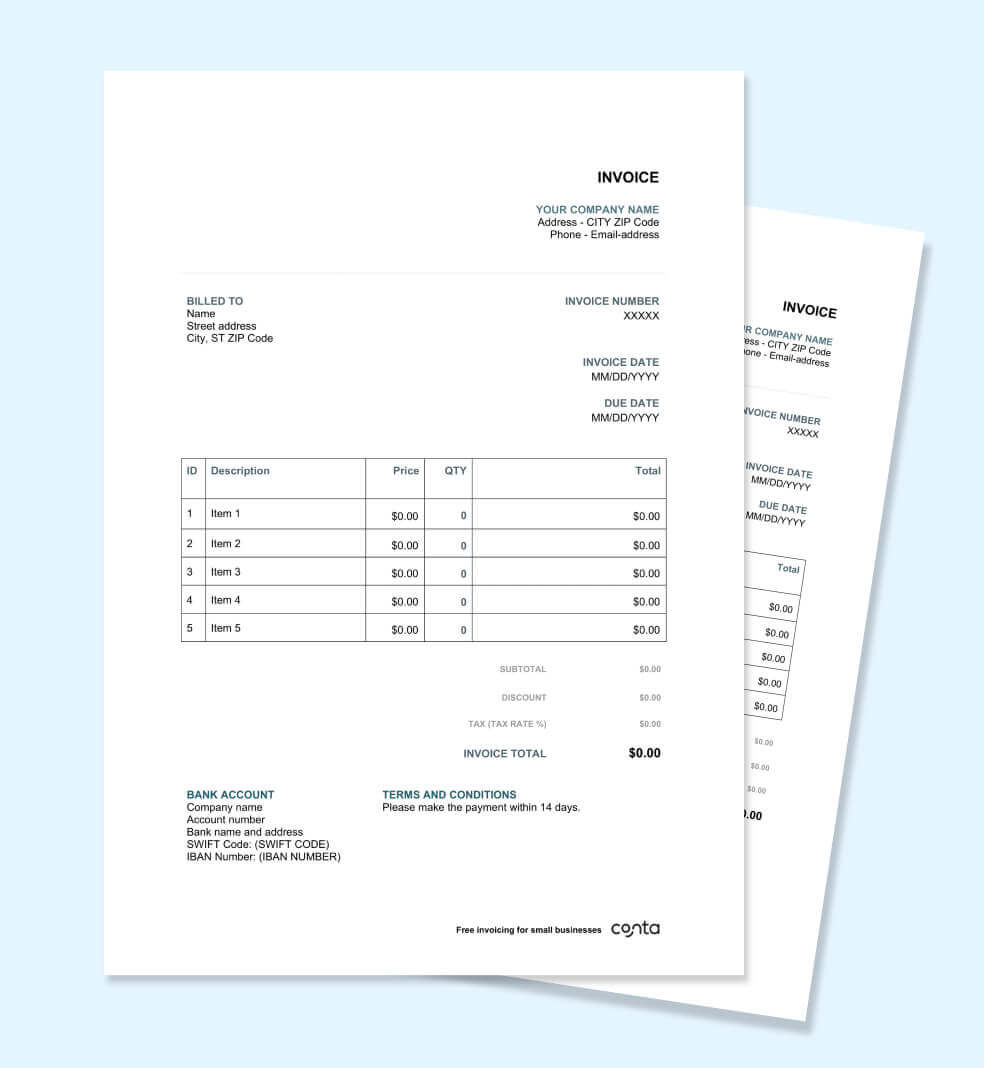

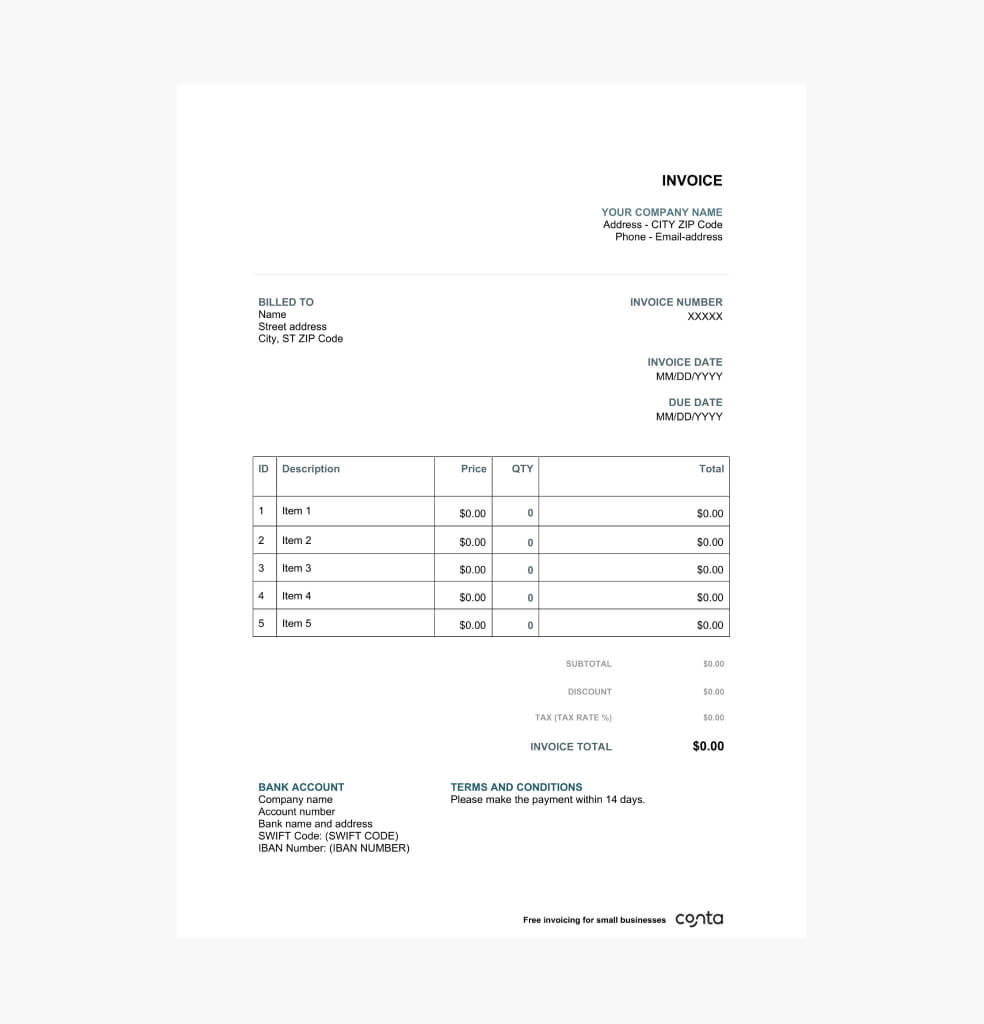

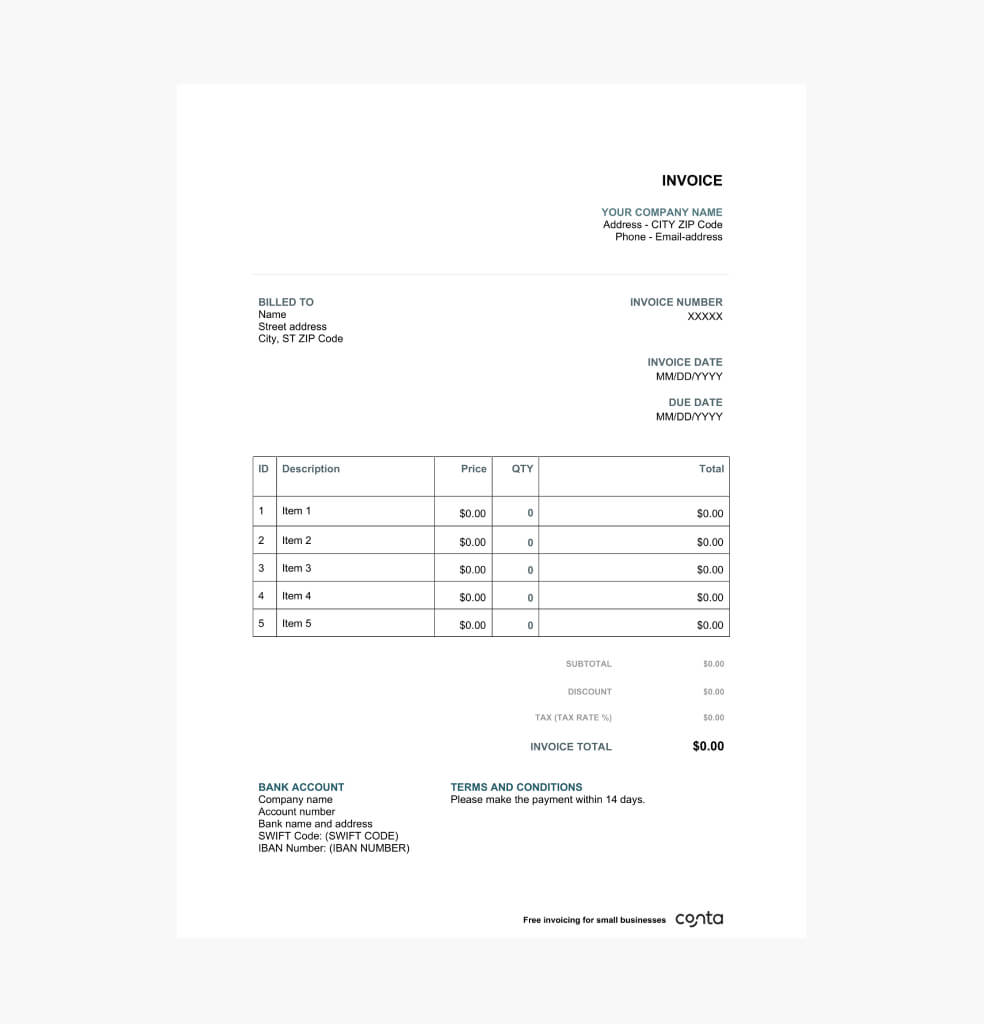

A consulting invoice template helps you invoice accurately, look professional, and—most importantly—get paid.