A proforma invoice is a preliminary bill of sale. In this guide, we’ll take a look at why proforma invoices are important and when to use them.

Have you ever found yourself in a situation where the client wants a confirmation of the sale before the product or service is delivered? That’s where you can use a proforma invoice.

A proforma invoice lists the products and services and costs. It looks like an invoice, but the document specifies that the goods or services haven’t been delivered yet. In short, it’s a confirmation that you intend to provide the goods or services.

In this guide, we’ll take a look at how and when to use proforma invoices.

Create free invoices with Conta

With Conta, you can create and send invoices in under 2 minutes. Just enter the client details, products and prices, and send it directly from the invoicing software. All your invoices are stored in one place and you can easily see which clients you need to follow up with.

What’s the difference between a regular invoice and a proforma invoice?

An invoice is a legally binding document requesting payment for goods or services that have been delivered.

A proforma invoice is a preliminary document sent before the goods or services have been delivered, but the information on both invoices is the same: goods and services, pricing, delivery date and business information.

When do you use proforma invoices?

You send proforma invoices at the initial stages of a transaction, usually when your client has committed to the purchase, but before you’ve delivered the products or services. Proforma invoices provide an overview of the transaction, and allows you or the client to make necessary adjustments before the goods and services are delivered and the actual invoice is issued.

You can create a proforma invoice to confirm the details with the client or the client can request it to verify the details, or for their own records.

For example, if you run a catering business, you can issue a proforma invoice when the client schedules the catering to ensure that you both agree on what’s going to be delivered. The client pays you when you issue the actual invoice, after confirming that it matches with the proforma invoice.

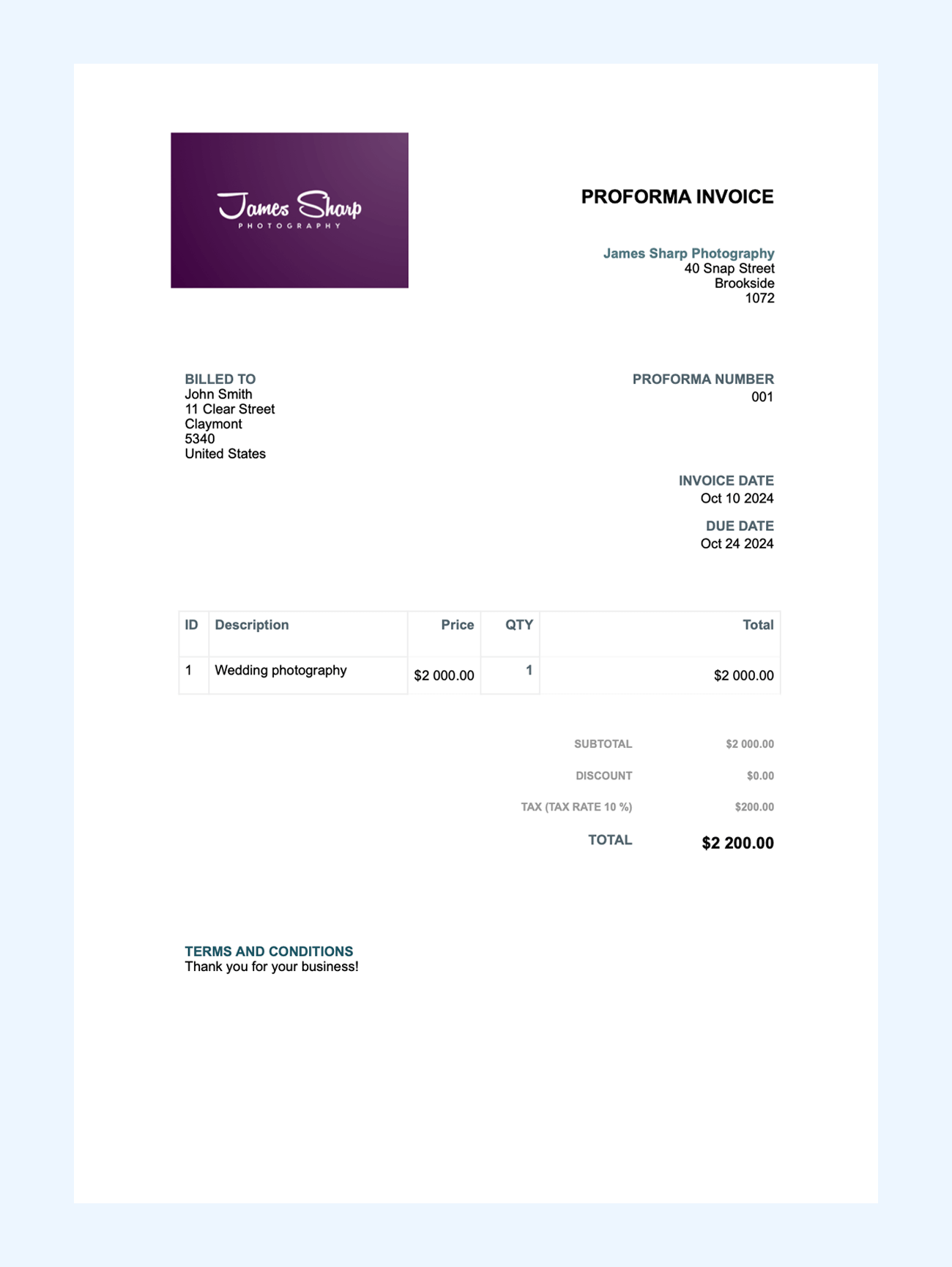

Proforma invoice example

Here’s an example of what it could look like:

How to create a proforma invoice

It’s a straightforward process, similar to how you make a regular invoice.

Many accounting or invoicing software give you the option to create proforma invoices or download a proforma invoice template. Alternatively, you can make your own template in Microsoft Word, Google Docs or Excel, or whatever program you’re comfortable using.

Here’s a simple step-by-step guide to creating proforma invoices:

1. Create a professional template

Create your own a template, use invoicing software or download a template to create a polished invoice, tailored with your logo and branding. Clearly label the document as “Proforma”, to make it clear that the actual invoice will be issued later.

2. Add your business information and contact details

Make sure to add your business information and contact details so it’s clear who the proforma invoice is from, and so your client can contact you if they have any questions. Add your client’s details, so it’s clear who it’s for.

3. Break down costs

Specify which services or products you’ll deliver: Add unit price, quantity and the total costs. Remember tax, if applicable, as well as any discount you might want to offer.

4. Save and send the invoice

Proforma invoices can be sent in many ways, such as via email, or in the mail. You can even send it directly from your invoicing software. The quicker you send it, the quicker you and your customer can agree on the details and proceed with the sale.

What to include on a proforma invoice

Usually, it includes:

- The header “Proforma invoice”

- The client’s details, such as business name or name, billing and shipping addresses

- Your details, your business name, address and contact information

- Payment terms

- The date the proforma invoice was created

- The date the proforma invoice is valid until

- Description and prices for the products or services

Pros and cons of using proforma invoices

The benefits:

- Clearly showing clients what you can offer them

- Demonstrating your commitment to the agreed prices and delivery dates

- The client acknowledges their intent to pay

- Streamlines the quote-to-cash process

- Can serve as a quote for internal purchase approval

- Reduces processing time and costs

The drawbacks:

- Not legally binding

- Potential confusion for clients who are unfamiliar with proforma invoices

- You have to spend time creating the proforma invoices, however it can be done much quicker with invoice software

Frequently asked questions

No, proforma invoices are not legally binding. They serve as preliminary documents sent to confirm the details of the sale, including which products or services will be delivered, the prices, shipping details, and delivery date. The client can confirm, negotiate, or reject the offer

No, you can’t claim tax on proforma invoices. They’re not legally binding, and they’re not meant to document that a sale has taken place—rather they act as a preliminary document to outline the details of the sale. You create legally binding tax invoices after the delivery of the goods or services in order to request payment.

Yes, you can cancel a proforma invoice. Since they’re not legally binding, you can cancel them if the client rejects the offer, or if you and your client don’t reach an agreement after negotiations.