For business owners, freelancers or contractors, having a positive cash flow is important. Nothing disrupts your cash flow more than unpaid invoices, so in this article we’ll take a look at what you can do to effectively manage outstanding invoices.

An outstanding invoice is an invoice that hasn’t been paid yet. An outstanding invoice can be due or overdue.

Once an outstanding invoice becomes overdue it’s not merely a financial inconvenience, it’s a problem you have to solve in order to maintain good liquidity and cash flow. Late payments can strain your relationship with suppliers; you might end up paying late because you haven’t got the money.

However, you have to ensure that you follow up on overdue invoices in a way that doesn’t damage the client relationships you’ve established.

Let’s take a look at some of the common reasons that invoices don’t get paid, as well as the steps you can take to increase the likelihood of getting paid.

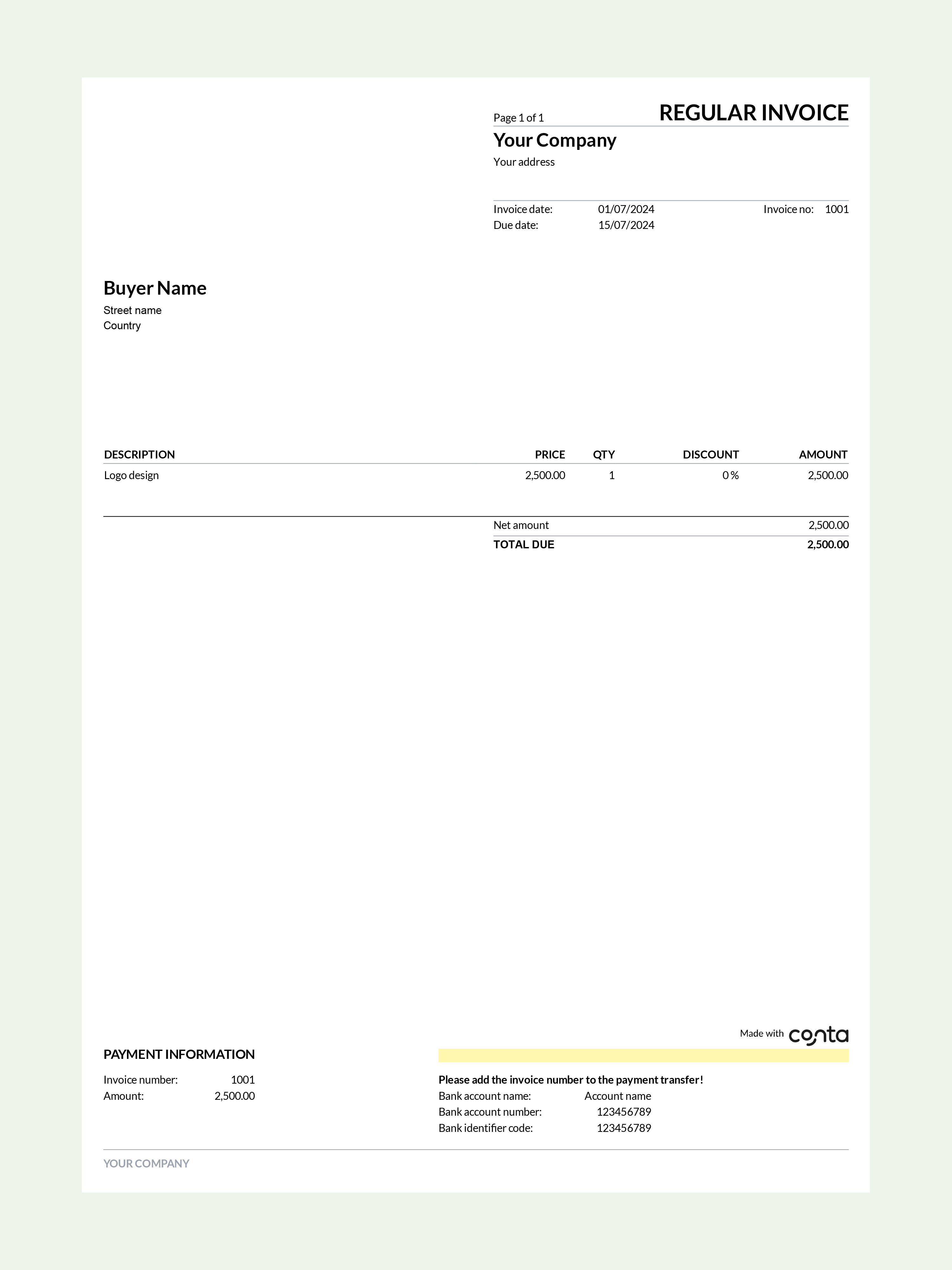

Create free invoices with Conta

With Conta, you can create invoices for free in under 2 minutes. Additionally, you can easily follow up on your invoices from the Conta dashboard: see which clients you have to follow up with and resend the invoice easily.

Common reasons why clients don’t pay outstanding invoices

There could be several reasons why clients don’t pay. Among the most common are:

- Financial challenges: Clients might have financial difficulties, which makes it impossible for them to pay on time.

- Errors on the invoice: Errors on the invoice, such as unclear invoice descriptions, missing payment terms or wrong amounts, can lead to your client paying late. It’s a good idea to use free invoicing software to make sure that you include all the necessary details.

- Dissatisfaction with your product or service: If the client isn’t satisfied with your product or service, it can lead them to pay late or not pay at all.

- The most important thing you can do to avoid overdue invoices, is to send invoices on time. You should do it as soon as you’ve delivered a product or service. This helps ensure that your clients remember you and can help you get paid quicker.

What is the deadline for claiming outstanding invoices?

Once an outstanding invoice is overdue, you can take steps to claim it.

The statute of limitations for overdue invoices varies from country to country, so you should check what applies in your country. It’s important to note however, that the debt usually doesn’t have to be collected within the statute of limitations; rather it is the deadline for initiating court proceedings to recover the debt.

How to follow up on late outstanding invoices, step by step

After the due date, it’s a good idea to follow up with your client.

- Review the terms of your contract: Ensure that you’ve clearly stated payment terms, due dates, and any late fees in the contract, so that you can follow up in a way that complies with the terms you’ve both agreed upon.

- Resend the invoice: Resend the invoice, and clearly state the due date, the outstanding amount, and any late fees.

- Send a gentle reminder: Send a polite reminder to your client to confirm that they’ve received the invoice and to check if they require additional information from you before going ahead with the payment.

- Call the client: Communicate with the client to identify and resolve any issues that are causing the payment delay. If they’re struggling to pay, maybe you can agree on a payment plan? If they’re unhappy with your product or service, maybe you can turn it around by offering a replacement or a discount.

- Send a letter of demand: If the reminders and the calls don’t work, you should send a formal letter of demand, stating the consequences if payment is not made within a certain deadline.

- Send a final notice: A clear and assertive email is a final attempt to resolve the situation in a peaceful manner.

- Escalate the situation: If all your attempts fail, you can consider taking legal action or hiring a debt collection agency.

Why use a debt collection agency?

A debt collection agency tries to recover money on behalf of creditors for a fee. These agencies will send letters of demand, make phone calls, and, if necessary, take legal action to recover the debt.

Some advantages of using a debt collection agency is:

- Professional intervention: Collection agencies have expertise in debt recovery, and can resolve the issue in an efficient and professional manner.

- Legal expertise: They understand the legal aspects of debt collection, and ensure that you and your client comply with laws and regulations.

- You save time: Outsourcing debt collection allows you to focus on the core activities of your business.

Best practices: What can you do to speed up the payment of outstanding invoices?

Know your clients

Understanding your clients and having a good relationship with them can help avoid a wide range of issues, including late payments.

Be clear about your expectations

Clearly outline payment terms, due dates, and any penalties for late payments in your contracts and in your communication with the clients.

See also: 4 benefits of signing contracts online

Consider requesting advance payments

If clients have a low credit score or a history of delayed payments, you can consider proactively safeguarding yourself by requesting part of or even the whole payment up front.

Send invoices promptly

Sending invoices as soon as you’ve delivered products or services shows clients that you run a professional business and can help you get paid quicker.

Offer early payment discounts

Provide incentives for early payments to encourage clients to settle invoices sooner.

Create free invoices now