Having good cash flow is an important part of running a solid business. Let’s take a look at everything you should know about liquidity and cash flow.

If your business is doing well, you’re both spending and earning money. Cash flow is a term used to describe the movement of money in your business.

Liquidity is how quickly your business is able to access cash, for example by having a solid reserve in the bank or a lot of cash on hand.

In this article, we’ll explain what cash flow and liquidity is and look at what you can do to improve and manage your cash flow.

What is liquidity?

Liquidity is a term that describes your business’s ability to readily access cash, for example by having enough money in the bank or cash on hand, or being able to quickly convert assets—like inventory, outstanding invoices, or equipment—into cash.

Having good liquidity is extremely important in order for your business to thrive and survive. If you don’t have enough money available, you won’t be able to cover day-to-day-operations, such as purchasing supplies or paying employees, which, in turn, will affect company performance.

As a business owner, you’ll also inevitably come upon unforeseen expenses—and you need to have enough funds to cover these.

Finally, if you have good liquidity, you can also take advantage of opportunities to expand, gain new clients, and invest in exciting new opportunities.

Do you want to create invoices for free?

With Conta, you can create unlimited invoices for free. Send straight from Conta or download a PDF invoice. Free invoicing software saves you time and money, and improves your cash flow.

What is cash flow?

Cash flow refers to the movement of money in and out of your business. If you have more money coming in than going out, you have a positive cash flow. If you have more money going out than coming in, you have a negative cash flow.

However, your company’s ability to settle its debts can’t be accurately assessed just by looking at the cash flow. The cash flow only takes into account the money flowing into your business that month, it doesn’t consider your liquid assets, like cash that you already have or inventory, which can be sold to cover costs.

Why cash flow and liquidity matters

If you don’t know how your business is performing, you could end up with your finances all in a disarray. Knowing what kind of cash flow you have and how good your liquidity is, enables you to improve where necessary and continue doing things that perform well.

For example, if you see that you spend too much money on software every month, you can switch to free software to save money—for example free invoicing software. If, for example, you see that you’re earning a lot on your investments you can continue investing.

Additionally, you can use the liquidity ratio and cash flow forecast and statements to demonstrate the financial health of the company and get investors onboard—or get a loan from a bank or a financial institution.

If you run a limited liability company, you might have to submit a cash flow statement once a year as part of your annual report.

How to calculate your liquidity

One of the most common ways of measuring liquidity is with a method called liquidity ratios.

Liquidity ratios are considered a better measure of liquidity than just looking at how much cash you have on hand, because they also include information about your liabilities.

While an asset is money or valuables that your company owns, a liability is something you owe, for example outstanding invoices, salaries or loans. Comparing the two with a liquidity ratio gives you a lot more information about how your business is doing.

We’ll take a look at three liquidity ratios: the current ratio, the quick ratio and the cash ratio. They all measure your company’s ability to pay off short-term liabilities with short-term assets, but they differ in how strictly they define what a liquid asset is.

Liquid versus non-liquid assets

When talking about assets we can divide them into liquid and non-liquid assets. Liquid assets are easy to convert into cash. Examples of liquid assets are actual cash and your bank balance.

Non-liquid assets are assets that take longer to convert into cash. One example is a company car. You can sell it to obtain cash, but you might not find a buyer immediately. You can probably sell the car faster if you reduce the price, but that also reduces the liquid potential of the car.

Current ratio

Current ratio includes all your current assets, meaning your cash, bank balance, your inventory, and your accounts receivable—the money that clients owe you. It’s the simplest liquidity ratio and least strict, in terms of what it considers a current asset.

The current ratio can also be called the working capital ratio.

The current assets are weighed up against your current liabilities, which is all the obligations you have to pay in the next 12 months. This covers loan payments, supplier payments, salaries, and other costs.

You can find your current ratio using this formula: Current assets divided by current liabilities

Example: Your current assets are $100 000 and your current liabilities are $80 000

$100,000 / $80,000 = 1.25 or 125%

If your current ratio is above 100%, it indicates that you have more current assets than you need in order to cover your expenses.

However, since there is some uncertainty included in the current assets—for example you could have a client who pays late or not at all—you should aim for a ratio of at least 2 or 200% to ensure you can cover costs.

Quick ratio

The quick ratio only includes what’s called quick or liquid assets, and excludes inventory from the calculation. This makes the quick ratio a more conservative assessment. The quick ratio is sometimes called the acid-test ratio.

Formula: (Current assets minus inventory) divided by current liabilities

Example: Your current assets are $100 000, and your inventory makes up $20 000 of that, and your current liabilities are $80 000

($100,000 – $20,000) / $80,000 = 1 or 100%

The quick ratio should ideally be above 1 or 100% to ensure good liquidity.

There’s also a version of the quick ratio which excludes prepaid expenses. In other words it includes cash and cash equivalents, short-term investments and accounts receivable. This is even more conservative than the example above. In that case, the formula would be:

(Cash and cash equivalents + short-term investments + accounts receivable) ÷ current liabilities

Cash ratio

The cash ratio is the strictest liquidity ratio. It excludes everything but cash or cash equivalents. Examples of cash equivalents include checks that haven’t been cashed or money in fixed-term savings accounts with a short term.

This liquidity ratio measures your ability to survive in an emergency situation.

Formula: Cash and cash equivalents divided by current liabilities

Example: Your have $50 000 in the bank and your current liabilities are $80 000

$50 000 / $80,000 = 0.75 or 75%

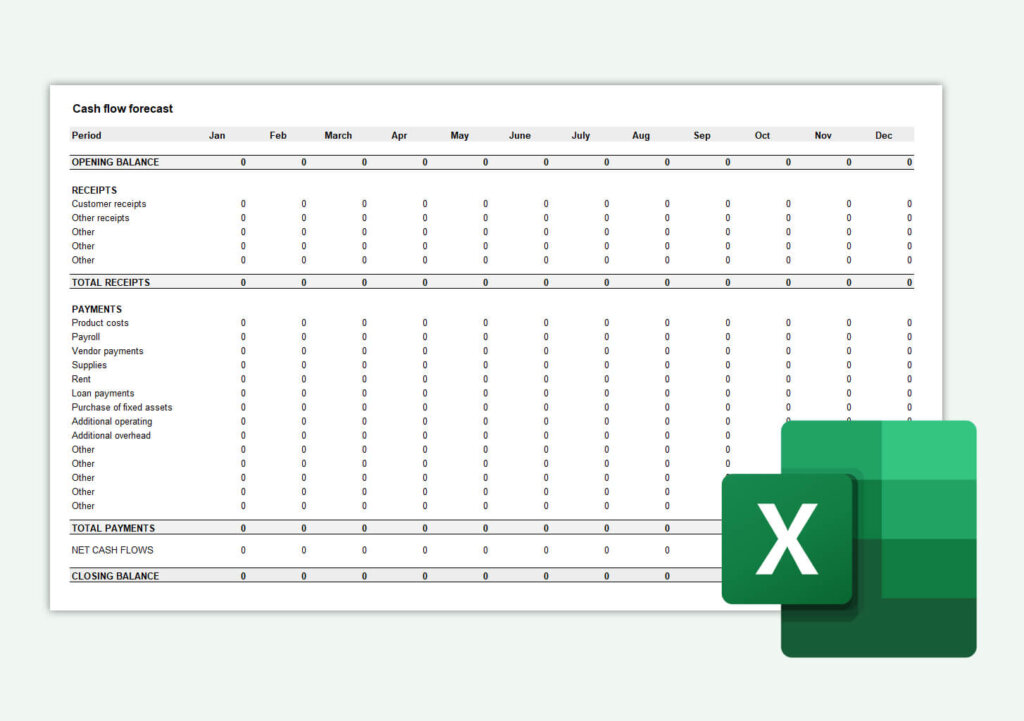

How to forecast your cash flow

Estimating how much money will flow into and out of your business over a period of time is called cash flow forecasting. It can also be called a cash flow budget.

This is how to create a simple cash flow budget:

1. Define your forecasting period

First you have to choose what kind of period you want to cover: a month, a quarter, a year and so on. A shorter time frame means your predictions will be more accurate because you have more information about your liabilities and assets.

If you, for example, go for a three-month time frame, you can set up a spreadsheet with three columns, each representing a month.

You can also download a free cash flow forecast to get started.

2. Fill in your receipts

Start by entering the opening balance for the period. This is how much money you have, including cash and bank deposits. Next, enter what you think you’ll receive. The highest number in this section will most likely be the money you receive from clients, but you can also get interest on bank deposits and dividends from stocks, for example.

2. Fill in your payments

Then add all your payments for the period, vendor payments, payments to the tax authorities such as payment of VAT or GST, withholding tax or other taxes, purchase of fixed assets, additional operating expenses, and payroll if you have employees. You can have other costs as well, it really depends on what kind of business you run.

The spreadsheet will calculate your net cash flow for the period, and show you the closing balance.

If you’ve set up cash flow statements, which show your cash flow in past periods, these are a great place to start to be able to estimate receipts and payments.

Example cash flow statement

This is an example of a cash flow forecast which covers a month.

| Opening balance | 120 000 |

|---|---|

| – | |

| RECEIPTS | |

| Customer receipts | 20 000 |

| Other receipts | 5 000 |

| Total receipts | 25 000 |

| – | |

| PAYMENTS | |

| Vendor payments | 10 000 |

| Purchase of fixed assets | 3 000 |

| Additional operating expenses | 2 000 |

| Total payments | 15 000 |

| – | |

| Net cash flow | 10 000 |

| Closing balance | 130 000 |

Help, I have a negative cash flow

Companies often have a fluctuating cash flow, which can be influenced by internal factors like new investments or hires, or external factors such as delayed client payments or changes in the industry. These can all cause negative cash flow for a period.

A negative cash flow isn’t necessarily a bad thing, you might be spending money now in order to earn more later. Examples of this include opening a new store, hiring more employees, making higher-quality products and so on.

Another example, is a startup, which secures a lot of investment at the start to shore up liquidity, but might operate with a negative cash flow until they’ve managed to create a good product, a good business model, a loyal customer base, or a combination of the three.

However, constantly operating with a negative cash flow will eventually result in a liquidity crisis, and, in the worst case, bankruptcy.

Read on to find the best way to improve your liquidity and cash flow.

How to improve your liquidity and cash flow

Remember that it takes continuous work to ensure good liquidity. Setting up a cash flow budget lays a great groundwork for this. There are several steps you can take to improve your liquidity and cash flow:

- Invoice often. Send invoices as soon as you’ve completed a job. The due date is calculated from the day the invoice was issued. The faster you send an invoice, the faster you get paid. See also 7 tips to get paid fast. Use a free mobile app to invoice on the go.

- Send payment reminders as soon as the invoice is overdue. With Conta, you’ll be notified when an invoice is overdue, and you can even turn on automated payment reminders.

- Set shorter due dates on your invoices so that you get paid faster. Read more about payment terms.

- Negotiate extended payment terms with suppliers. Having a good relationship with your suppliers can really improve your cash flow.

- Manage your inventory well. Sell excess inventory to prevent tying up a lot of capital, and set up a good inventory management system.

- Take up additional loans or refinance your loans to pay less interest. Note that taking up additional loans isn’t a long-term solution to bad liquidity, but it can help you weather a period where you’re trying to invest and grow your business.

- Laying off employees or selling equipment and machinery. This might not be the best long-term solution, but you can see whether you’re overspending on employees or equipment that you don’t necessarily need. Maybe you need to cut back and improve your business model before you can scale up again?

These are just some suggestions, and which strategy works best for your liquidity and cash flow depends on your specific situation.

Pro-tip: Cut costs where you can

To save money, you should look at how to reduce what you’re spending. You could, for instance, switch to a free invoicing software, like Conta. You can sign up and start sending invoices for free today. Read more about how to save money and cut costs.

Frequently asked questions about liquidity and cash flow

Liquidity is the ability your business has to pay bills from suppliers and cover fixed costs, as well as unforeseen expenses. Liquidity can be worked out using different liquidity ratios—some are more conservative than others.

Having good liquidity is vital to run a solid business.

See also: How to improve the liquidity of your business

Cash flow is a term used for the difference between payments and receipts in a period, in other words, the difference between money coming in and going out of your business. Positive cash flow is the sign of a healthy business.

See also: How to calculate cash flow

Liquidity and cash flow are two different things. While cash flow looks at the money flowing into and out of your business, liquidity looks at how well you’re able to convert assets to cash, or to readily access cash.

They’re tied together though, and a solid business will have both a good cash flow and solid liquidity.

Liquid assets are assets that can be converted into cash easily. Cash is the most liquid asset because it’s ready to use. This covers both cash on hand and the amount you have in your bank account. Less liquid assets include accounts receivable and inventory.

Yes, more cash would mean more liquidity, but you can also have a liquid business if you have a lot of inventory, accounts receivable and short-term investments. However, a sizeable portion of your liquid assets should be cash.

To check if you have enough cash, you can use the cash ratio formula outlined above to work out your liquidity.

While cash flow simply looks at how much money flows into your business and out of your business over a period of time. Profit is what you’re left with after you’ve subtracted your costs and taxes from your income. Read more about profit.