You’ve sold an item or provided a service—it’s time to send your first invoice! This guide explains how to type an invoice, as well as how to manage and send invoices efficiently.

Invoicing used to be a tedious and time-consuming process; you had to manually create and print out invoices and then send them in the mail. Invoices took a long time to get where they were going—sometimes they even got lost on the way—which could make both you and your client frustrated.

Today, invoicing is much easier and much more efficient.

In this guide we’ll go over everything you need to know about invoicing: We’ll show you how to to type an invoice, how to send an invoice, how to get paid on time, and even how to use invoicing software to automate and streamline your invoicing.

Before we dive in, let’s go over the basics. 👇

What is invoicing?

When you run a business, you offer products or services to your clients. At the end of the day, you want to receive payment for the work you’ve done. That’s where invoicing comes in.

Invoicing is the process of creating a bill for the products or services you’ve sold to a client. It is a way of requesting payment for your work, and it also helps you keep track of your income.

An invoice typically includes details such as which products or services you’ve provided, the total amount due and payment terms.

Sales invoices are the most common type of invoices. You use them to request payments from clients. Other types of invoices include

- proforma invoices: An invoice used to confirm sale details before goods or services are provided.

- recurring invoices: Invoices that you issue at regular intervals, such as monthly or yearly.

- past due invoices: When clients haven’t paid on time, you can resend the invoice—sometimes with additional charges.

- credit invoices: You issue a credit invoice to reduce what a client owes your business, mostly when you need to correct an error or when the customer returns goods. This is also called a credit note

Why invoicing is important

Sending invoices is the way to get paid. Invoicing also helps you

- keep track of finances: When you create invoices for every sale, you maintain a comprehensive record of what you earning, which is essential for both accounting and tax purposes.

- build trust with customers: Sending a clear, correct and professional invoice, demonstrates your commitment to your business and to maintaining a good relationship with your clients.

- ensure timely—or even early—payments: When you send an invoice you clearly communicate when and how you want to get paid. If you send the invoice in a digital format, for example via your invoice system or via email you can reduce the time to payment by 7 days, compared to other invoice formats.

- resolve misunderstandings: If there are any questions or disputes about the goods or services provided, invoices act as a reference that can help you resolve any misunderstandings.

See also: How to handle outstanding invoices

Pro-tip: Use polite language to get paid faster

Business that use polite language in invoices, for example words such as “please” and “thank you”, get paid five percent faster. This is one of the steps you can take to get paid early. Polite language also helps build better client relationships.

How to type an invoice

When it comes to creating invoices, there are three main options: Invoice templates, invoice generators, and online invoice software.

You can customize invoice templates to fit your needs. It’s easy to get started—You can use invoice templates in programmes you’re comfortable with, such as Microsoft Excel or Word. A major drawback, however, is that using templates is more complicated than an invoice generator or invoice software: The invoice can’t be sent directly from the software, you have to convert to PDF and then attach it to an email. And depending on what programme you use, you might also have to calculate tax and discounts manually.

Online invoice generators are a faster alternative The downside, however, is that they often lack vital features such as invoice storage and you can’t send payment reminders to follow up on overdue invoices. Additionally, most invoice generators don’t allow you to tailor the templates to your needs.

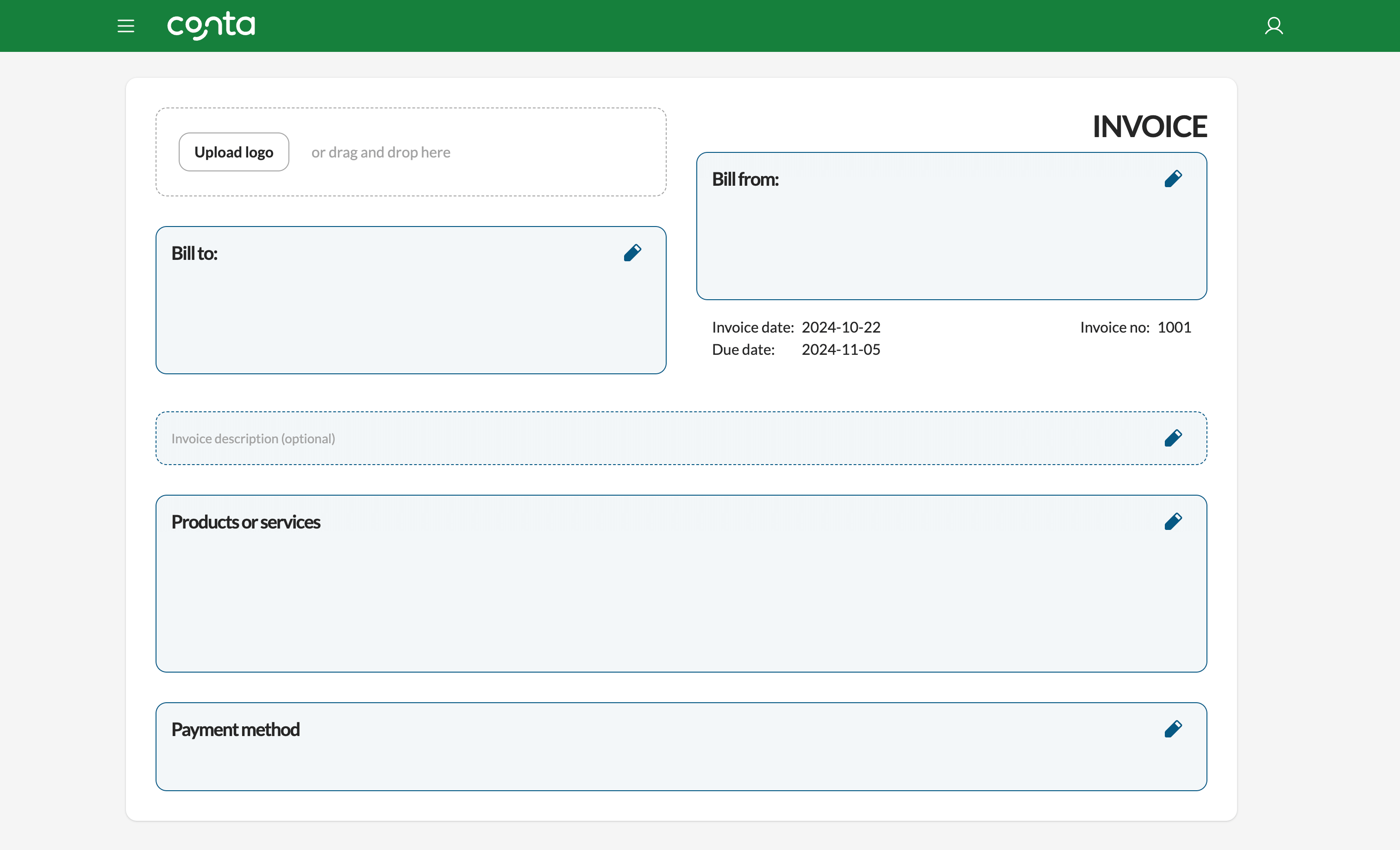

Invoicing software (like Conta's free invoicing app is the most efficient and practical option for contractors, freelancers, startups, and small business owners. When you use invoicing software, fields like invoice number, your contact information, and the clients information are automatically filled out, simplifying the process. Additionally, invoicing software often has smart features such as recurring billing. All your invoices are stored safely in one place, and you can easily follow up on overdue invoices.

How to type an invoice: invoice template vs. free invoice software

| Features | Template | Conta |

| Cost | $0 | $0 |

| Printable | ✅ | ✅ |

| Email to clients | ✅ | ✅ |

| Track sales and sales tax for accounting | ❌ | ✅ |

| Unlimited invoicing | ❌ | ✅ |

| Send automatic payment reminders | ❌ | ✅ |

| Recurring invoicing | ❌ | ✅ |

| Track invoice status | ❌ | ✅ |

| Add collaborators | ❌ | ✅ |

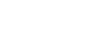

How to type an invoice: What to include

A well-designed invoice communicates the necessary information to the client and helps you get paid on time. Here’s four of the key components you should include:

1. Invoice header

At the top of the invoice, you have to include key information. You have to include the word “invoice,” to make it clear that the document is an invoice.

Additionally, you should include your information and contact details to make sure that the clients know who sent the invoice. The same goes for the cient information—make sure that it’s clear who the invoice is form.

Lastly, it’s important to include a unique invoice number, the invoice date, and the due date.

2. Item description

The item description is an important part of the invoice as states which products or services the client has purchased. You should list each item in detail, along with the amount, the unit price, and any discounts, taxes, or shipping costs.

You have to ensure that the customer fully understands what you’re charging them for. It’ll also make it easier for the client to pay you and to reconcile the invoice with their own records.

3. Payment terms

Payment terms ar an important part of the invoice as it tells the client when and how to pay you.

On your invoice, you should clearly state the due date as well as the preferred method of payment. It’s also important to include any additional information such as late payment fees, so that there are no misunderstandings between you and the customer.

Studies show that some words and phrases lead to earlier payments than others. If you include a “thank you” in your payment terms, you’re likely to get paid almost 90 percent faster. Using “please” has similar results.

Having clear payment terms helps ensure timely payments and can improve your cash flow.

Here you can see how to type an invoice in Conta’s free invoicing software:

How to type an invoice: Common mistakes to avoid

When it comes to how to type an invoice, there are a few pitfalls that you need to avoid. These are the most important ones:

Not sending invoices promptly: You should send the invoices as soon as you’ve delivered the goods or services. If you wait too long to send invoices, it can make it more difficult to collect payment and it will also increase the time until you can get paid, which is bad for the financial health of your company. Sending invoices late can also cause confusion for the client and can result in them not doing business with you again.

Invoicing the wrong customer: People hate being invoiced for services they’ve not received! You should double-check client information to ensure you’re invoicing the right person. This will help you maintain a professional image and avoid payment delays. Also check that you’re invoicing for the correct products and services.

Not following up on overdue invoices: Following up on overdue invoices is a critical part of the invoicing process. If you don’t follow up with client, they may not realize they’ve not paid you yet. This is how to handle overdue invoices.

Relying on manual invoicing: Make sure to use invoicing software that allows you to create and send invoices quickly and effectively. The free invoice software from Conta is used by more than 148 000 freelancers, contractors and small businesses.

How to type an invoice faster

Technological advancements can help you create, send and follow up on invoices. These features not only save you time, but also reduces human error

Here’s how to automate your invoices:

- Go with invoicing software. There are many invoicing softwares available in the market, with different features and pricing plans. Take the time to research and choose the one that suits your business needs. We’ve reviewed the top 5 invoice apps.

- Set up automatic invoicing for your repeat clients, and create and send invoices with a few clicks.

- Turn on automated payment reminders to make sure that clients are notified when an invoice is not paid on time.

What can I do when clients don’t pay invoices on time?

Unfortunately, clients don’t always pay on time. If a hasn’t paid, you should do the following:

1. Send a payment reminder

Send a gentle reminder to the client. In most cases, a polite and professional reminder will prompt the client to pay the overdue invoice.

In Conta, you can soon set up automated payment reminders. This is a feature that sends out automated notifications to your customers when their invoice is due, helping your business to get paid faster.

2. Ask why the client hasn’t paid

In some cases, there’s a good reason why the customer hasn’t paid you. Give them a call or send them an email; once you know what the issue is, you can address it. If, for example, he client is unable to pay the entire amount, you can set up a payment plan.

3. Escalate the situation

If the client is unwilling or unable to pay, you can consider escalating the situation. This can involve sending a formal letter of demand or starting legal proceedings.

4. Hire a debt collection agency

If all the above steps have failed, you might need to hire a debt collection agency to help you recover the owed amount. They can handle the matter professionally and increase the chances of receiving payment.

Trends and innovations in how to type an invoice

Invoicing has come a long way in the past decade, with the majority of invoices now being created and sent electronically. In some countries, electronic invoicing formats are in fact required by law in the public sector.

Moving forward, we expect that invoicing will become even more digital and more automated. More and more invoices will be sent in standardized electronic formats, and an increasing number of businesses will offer one-click mobile payments.

We also expect that mobile invoicing and the use of integrations will escalate. This means businesses can create invoices on the go – and send them immediately after they’ve delivered a product or service.

Another recent development, which might advance in the years to come, is the use of blockchain technology to make accounting more reliable. Instead of the traditional double-entry system, companies are now testing practices in which all transactions are simultaneously posted in three places – between the two parties involved in the transaction and a separate, impartial recording entity.

It’s likely that invoicing will continue to change as technology advances. To ensure you remain competitive, you should keep up with developments and advances.

Did you know you can send invoices for free?

With the free invoice software from Conta, you can speedrun your invoicing. Try it now, and manage your invoices effortlessly.