If you haven’t created a receipt before, it’s important for your business that you learn how to do it. In this guide, we’ll explain how you can easily create a receipt and what you need to include.

You’ve sold an item and received payment, now you need to give your customer a proof or purchase. But how do you make a receipt?

If you’re a new business owner, you likely have some questions about what information to include in your receipts. If you’ve been in the game for some time, think of this as a refresher.

Let’s start with some basics. 👇

What is a receipt?

A receipt is a document that serves as proof of purchase: It shows that something was bought. When a customer enters your store and buys a product or a service, they’re entitled to a receipt. Customers will also often request receipts for their own record-keeping or in case they need to provide proof of warranty.

How to make a receipt

You can create receipts in several different ways. In most cases, you’ll use a point-of-sale system (POS), also called a cash register system. If you don’t have a POS, there are some alternatives:

Build your own template

Many business owners create their own receipt templates in Google Docs, Microsoft Excel, or Word. This is a cost-efficient alternative, and also gives you complete control over the layout of the receipt. Download a free template to start making your receipts.

The downside, however, is that you have to manually add a unique reference number to each receipt, and you run the risk of human error. Also, be aware that in some countries, you can’t use templates because these reference numbers are added manually.

Did you know you can get a free receipt template?

You can create professional receipts with our free receipt template. Download now and simplify the process of sending receipts to clients after they’ve paid you.

Buy a receipt book

Receipt books with preprinted reference numbers can be a good solution for businesses that don’t have a POS system. They’re easy to use and affordable. A receipt book is also called a receipt pad.

There are, however, several downsides to using receipt books. For instance, there’s the fact that it’s time-consuming to manually issue receipts. Additionally, you have to manually enter transactions into your accounting system, which is another time-consuming activity.

Create a cash invoice

A cash invoice, also known as a cash receipt, is an invoice that proves that a sale has taken place and that you’ve received a cash payment. The main benefit of using invoicing software to create receipts, is that it saves you a lot of time. You can easily export a complete record of sales to your accounting system, and the risk of human error is minimal.

A downside, however, is that invoicing software often comes at a cost. We’ve compared the 5 best invoice apps to help you choose.

Is a cash invoice the same as a sales invoice?

Invoice software can help you create both sales invoices and cash invoices, but you use the two types of invoices for different purposes.

Sales invoices are invoices you send to your customers to request payment for goods or services that you’ve provided.

Cash invoices are invoices that you give to your customers to show that you’ve sold them something and that the customer paid in cash at the time of purchase.

See also: Invoice vs. receipt: What’s the difference?

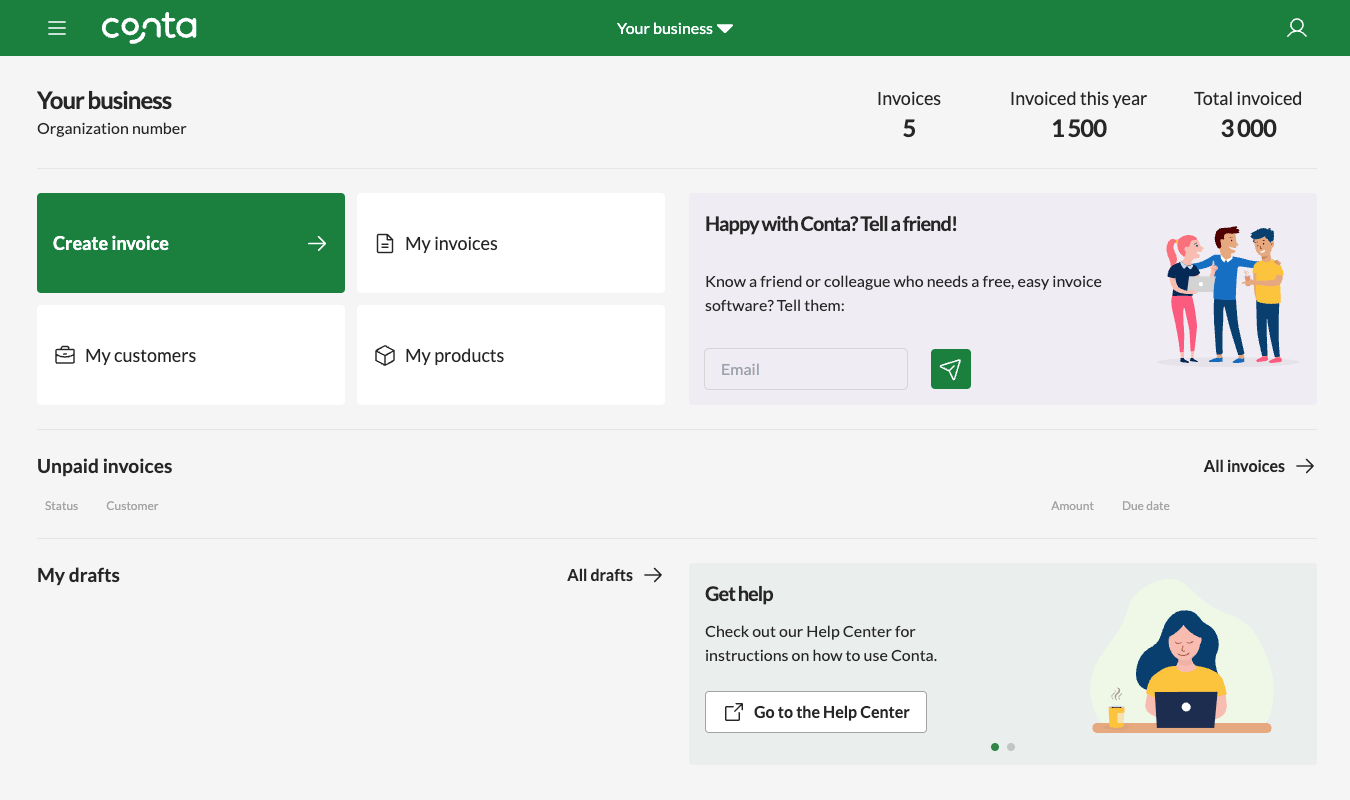

Do you find creating invoices overwhelming? In Conta, you can create sales invoices for free. By using invoice software, you make sure that you include all mandatory information on your professional invoices and you can follow up on all your invoices in one place.

6 things you should include in a receipt

When you’ve chosen your preferred method of creating receipts, you’ve got to make sure that your receipts include the necessary information.

Receipts must include

- the name and organization number of your business

- a description of the goods or services you’ve sold

- where the goods or services were sold/delivered

- the price of the goods or services

- value-added tax (VAT) or goods and services tax (GST), if applicable

- a receipt number

In addition, your receipts can include other information such as your return and refund policy, or the name, address, and organization number of the buyer, for accounting and tax purposes.

Receipt template example

Here is an example of a receipt template that you can create in a spreadsheet program like Microsoft Excel or Google Sheets:

Business name

Business address

Phone number

Receipt number

Customer name

Item 1: Quantity, unit price and total price

Item 2: Quantity, unit price and total price

VAT/GST rate

VAT/GST amount

Price incl. VAT/GST

Making a receipt: Putting it all together

Let’s summarize what we’ve gone through.

The best way to make receipts is using a POS system, but if you run a company with only a few cash transactions, getting a POS might not be the ideal solution for you. It can take a long time to get it set up and it can be expensive to both purchase and upgrade.

If you want to use a receipt template, you have to make sure that you’re allowed to do so in the country you operate in.

In general, cash invoices are the best alternative to creating receipts in POS systems. It’s easy to generate cash invoices and they comply with accounting and tax requirements.

Are you looking to send invoices for free?

If you’re looking for an easy and affordable way to create, send and manage invoices, Conta can help you out. You can create professional invoices in under 2 minutes.