A profit and loss statement shows whether your business is earning or losing money. This profit and loss statement example will help you get started.

A profit and loss statement shows your businesses’ profit and loss for the past tax year. The profit and loss statement shows whether you’re earning or losing money. That’s why it’s such an important report for your business.

The profit and loss statement can also be called an income statement.

See also: What is a profit and loss statement?

Pro-tip: Set up a profit and loss budget

A profit and loss budget—also called an operating budget or a P&L budget—attempts to predict whether your business will earn or lose money in an upcoming period.

This is one of the most important budgets in your business: It’ll tell you if you’re operating with a profit or loss, how much money you’re making, and give you an idea of how much you’re going to pay in taxes.

Why use a profit and loss statement?

There are many reasons to set up a profit and loss statement, but the most important one is that you get to see whether you’re earning or losing money. Additionally the profit and loss statement lets you

- compare your business’ performance across several tax years. This helps you see if your business is becoming more profitable over time

- ensure that your revenue is growing faster than your expenses

- catch high costs early so that you can take steps to reduce them, for example by delaying large purchases or hires, laying off employees, taking out a loan, or switching to free invoicing software

- give investors, stakeholders and shareholders important information about your business

- easily make profit and loss budgets, since you can use past numbers as a starting point

- base your business strategies on concrete financial data

Some businesses also have to submit an annual report, which includes a profit and loss statement.

Profit and loss statement example with explanations

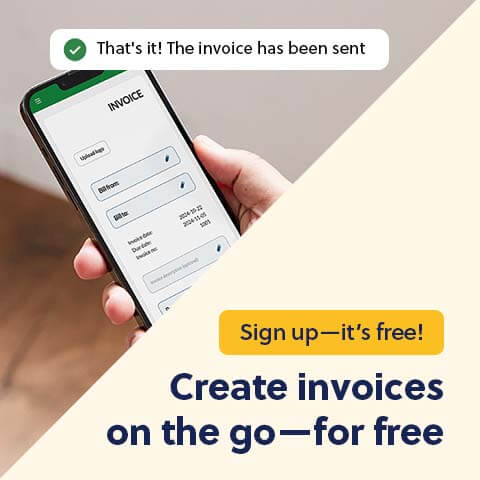

| 2024 | 2023 | |

|---|---|---|

| Revenue | ||

| Sales revenue | 80 000 | 60 000 |

| Earnings from the sale of assets | 20 000 | |

| Net sales | 100 000 | 60 000 |

| – | ||

| Cost of goods sold | ||

| Material | 20 000 | 10 000 |

| Labour | ||

| Overhead | ||

| Total cost of goods sold | 20 000 | 10 000 |

| – | ||

| Operating costs | ||

| Depreciation and amortization | 200 | |

| Advertising | 10 000 | 5 000 |

| Repairs and maintenance | 1 000 | 500 |

| Office rent | 20 000 | 20 000 |

| Shipping | 800 | 600 |

| Insurance | 500 | 500 |

| Office supplies | 600 | 300 |

| Other expenses | ||

| Total operating costs | 33 100 | 26 900 |

| – | ||

| Earnings before interest and taxes | 46 900 | 23 100 |

| – | ||

| Finance | ||

| Income from interest | 4 000 | 4 000 |

| Other financial income | 500 | 500 |

| Expenses from interest | 1 000 | 1 000 |

| Other financial expenses | 200 | 200 |

| – | ||

| Earnings before taxes | 50 200 | 26 400 |

| Tax expense (10%) | 5 020 | 2 640 |

| Net profit | 45 180 | 23 760 |

Usually the profit and loss statement covers a year, but you can also set it up to cover a month or a quarter. It’s a good idea to compare it with the previous period—either the year before, or the month or quarter the year before—so you can see how your numbers change.

You can of course adjust the template to your needs by adding relevant fields and removing fields that you don’t need.

Revenue

In the revenue section, you enter what you’ve earned from sales, both goods and services, and from the sale of assets.

Cost of goods sold

Cost of goods sold are the costs directly related to the production and sale of goods. That includes the cost of purchasing material and labor costs that can be tied to production—for example hiring a third-party for a specific project.

Operating costs

Operating expenses are all the other costs in your business. You can adjust these fields as needed. We’ve included the following costs: depreciation, advertising, repair and maintenance, office rent, shipping, insurance, and office supplies.

There’s also a field for other expenses.

Finance

The finance section includes income from interest, which you’ll get if you have money in a savings account, as well as other financial income, for example dividends from shares or gains from the sale of shares.

Additionally, you add expenses related to interest—in other words, interests that you pay on loans. You can also add other financial expenses, such as loss from the sale of shares.

Taxes

Add how much tax you’ll pay, based on what the tax rate is in your country.

Reviewing the profit and loss statement

When the profit and loss statement is done, it’s time to review the numbers. The template calculates it all for you, so that you can instantly see your net profit or loss.

It’s important to look at how your numbers compare to the previous period—are you earning more or losing more money? You can also identify your biggest expenses. You might need to cut costs to increase your net income.

If you’re unsure about how to interpret the profit and loss statement, you can speak to an accountant. They can also help you set it up.