Establishing and maintaining good cash flow is important in order to keep your business healthy and thriving. Here’s everything you should know about liquidity and cash flow.

Companies often have fluctuating funds, which are influenced by internal factors like new investments, as well as external factors such as delayed client payments or changes in the economy. Setting up a good cash flow is important for, not just surviving, but thriving in an ever-changing business landscape.

In this article, we’ll explain what liquidity is and look at some measures you can take to enhance your access to cash and manage your business’ cash flow.

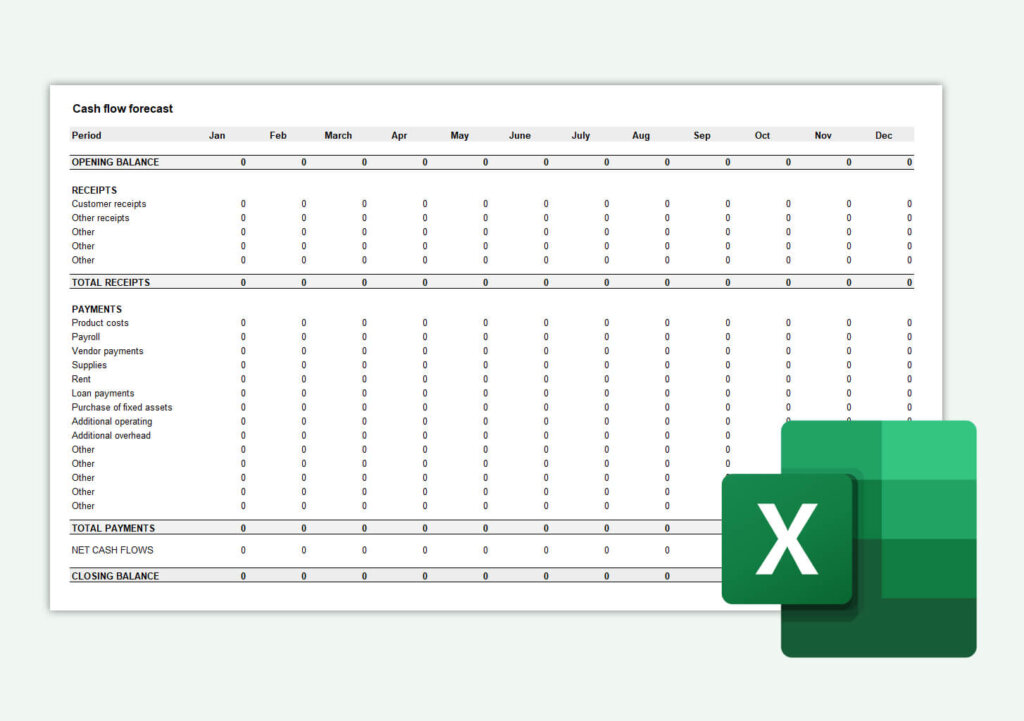

See also: Free cash flow forecast template

Do you want to create invoices for free?

With Conta you can create unlimited invoices for free. Send via Conta or download as a PDF to send via email. Free invoice software will help you save time and money and improve your cash flow.

What is liquidity?

Liquidity, an important concept in business management, is a business’s ability to swiftly convert assets into cash or to readily access cash.

Having a healthy liquidity reserve is vital for your business to grow and survive. Without good liquidity, you’re not able to make investments, purchase supplies or pay employees, which, in turn, will likely affect company performance.

What is cash flow?

Cash flow refers to the movement of money in and out of a business.

Unlike liquidity, the ability of a company to settle its debts cannot be accurately assessed merely by looking at the cash flow. Instead, cash flow is a measure of how much money a business is bringing in and spending over a period of time.

Calculating liquidity ratios

One of the most common ways of measuring liquidity is with liquidity ratios.

Liquidity ratios are considered a better measure of liquidity than cash on hand because they provide a better assessment of a company’s ability to meet its short-term obligations.

Current ratio and quick ratio are both liquidity ratios that measure a company’s ability to pay off short-term liabilities with short-term assets. However, they are some differences in how they are calculated and used.

Current ratio includes all current assets, while the quick ratio only includes quick or liquid assets and excludes inventory from the calculation. This makes quick ratio a more conservative assessment.

Both ratios are helpful for financial analysis, but which will be better for your company depends on what you want to assess, and which industry you are operating in.

Liquidity ratio 1 (current ratio):

Formula: Current assets divided by current liabilities

Example: If your current assets are $100 000 and current liabilities are $80 000

Calculation: $100,000 / $80,000 = 1.25 or 125%

A current ratio above 100% indicates that you have more current assets than you need to cover expenses. However, since there is some uncertainty when it comes to receiving payment from customers, aiming for a ratio of 2 (200%) or higher is a good idea to ensure robust liquidity.

Liquidity ratio 2 (quick ratio):

Formula: (Current assets minus inventory) divided by current liabilities

Example: Using the previous data and adding an inventory of $40 000

Calculation: ($100,000 – $40,000) / $80,000 = 0.75 or 75%

The quick ratio, excluding less liquid assets like inventory, should ideally be above 100% to ensure good liquidity.

Cash flow forecasting for liquidity management

Cash flow forecasting is the process of estimating cash inflows and outflows to predict what the liquidity will look like over a period of time.

By estimating the future cash balance, businesses gets a clearer picture of how their financial situation will evolve.

How to forecast cash flows

To create a simple cash flow budget, you can follow these steps:

1. Define your forecasting period:

Begin by determining the time frame of your forecast. A shorter time frame increases the accuracy of your predictions. For instance, if you opt for a three-month time frame, create a spreadsheet with three columns, each representing a month.

2. Fill in the spreadsheet:

Start by entering the initial cash balance for the period in the first column. Below, list anticipated cash inflows and outflows. By combining the initial balance with the net change in cash flow during the month, you can calculate the estimated cash balance at the end of each month.

3. Repeat for subsequent months

Apply the same process to the following months, adjusting the values based on your expectations for each period.

Don’t want to do it on your own? You can download our free cash flow forecast template.

Improving liquidity and cash flow

Ensuring good liquidity is a continuous effort, and effective cash flow forecasting lays the groundwork for this.

Here are our best tips to improve your company’s cash flow:

- Improve your invoicing procedures: Send invoices promtly after completing a job to get paid faster. You might also consider reducing the payment deadline for your clients.

- Proactive payment reminders: In instances where clients fall behind on payments, send payment reminders promptly.

- Apply for a credit line: Explore the possibility of securing a credit line, allowing you to pay interest only. This provides flexibility in managing short-term cash needs.

- Manage supplier relationships: Negotiate extended payment terms with suppliers and explore opportunities to increase credit limits, particularly with key suppliers. Cultivating strong supplier relationships can make a significant improvement to your cash flow.

- Optimize inventory management: Trim excess inventory to prevent the unnecessary tying-up of capital. Implementing efficient inventory management practices will help you reach your liquidity goals.

Pro-tip: Cut costs where you can

You could, for instance, switch to a free invoicing software, like Conta. You can sign up and start sending invoices for free today.